MADISON, Wis.—Huawei and Qualcomm, two

cellular technology giants, are muscling their way into the nascent

vehicle-to-vehicle (V2V), vehicle-to-infrastructure communication

market, often collectively titled V2X, by proposing a new LTE standard

called “LTE V2X.”

The move is at odds with incumbent automotive technology suppliers

who have been working more than a decade to develop and test — and

finally implement — a Dedicated Short-Range Communications (DSRC)

technology designed for V2V, V2I communications.DSRC, based on the IEEE 802.11p standard, uses a dedicated wireless frequency — 75 MHz of spectrum in the 5.9GHz band — allocated by the Federal Communications Commission in 1999 specifically for intelligent transportation systems.

Meanwhile, proponents of LTE V2X are pitching LTE-based cellular network infrastructure as the basis of V2X. They claim that LTE Direct (LTE-D), also known as LTE Device-to-Device (D2D), offers a good foundation for LTE V2X development. LTE-D is said to enable discovery of thousands of devices and their services within 500 meters, thus allowing two or more proximal LTE-D devices to communicate within the network.

The result of these developments is a connected-car clash between the DSRC faction, and others jockeying for a foothold in the automotive industry in the anticipation of the emerging 5G cellular network standard. Cellular players are counting on 5G to offer native support for automotive-related communications.

As EE Times talked to several automotive technology vendors last week during Intelligent Transportation System (ITS) World Congress in Bordeaux, many were visibly unhappy about last-minute efforts by Huawei and Qualcomm to push an alternative V2X communication technology.

Lars Reger, chief technology officer of NXP’s Automotive business unit, believes DSRC has already come a long way. The technology, which has cleared a number of field tests over the years, is about to go inside new connected cars. Noting that LTE V2X is still in development, Reger estimated substantial delays before the new standard is finished, tested and accepted by the automotive industry.

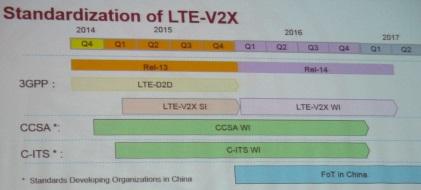

Huawei’s

timeline shows the LTE-V2X Study Item completing its work by the end of

this year. The LTE-V2X Work Item begins in 2016.

(Source: Huawei)

(Source: Huawei)

So, here’s the question. Do carmakers now see something wrong with designing DSRC into their cars, after mulling it over and dragging their heels for more than 15 years?

When EE Times asked Huawei if carmakers have asked them to develop an alternative V2X technology, Jiansong Gan, technical director, connected car at Huawei, paused a second and said, “That’s a good question.”

But he pointed out that the advantage of promoting LTE-based V2X is that a “LTE cellular network infrastructure already exists.” There is no need to build a V2X infrastructure afresh to support DSRC.

Gan also cited the potential interference issues of 5.8GHz DSRC in China and explained, “In China, we need a different V2X solution.” The Chinese Communication Standards Association (CCSA) already launched a Work Item for LTE-based V2X in China.

Asked about the emerging conflict between DSRC and LTE V2X, Guang Yang, senior analyst responsible for wireless operator strategies at Strategy Analytics, called DSRC “still the mainstream technology for V2X.” He added, “Technically speaking, DSRC has nothing wrong, I think.”

Yang explained that the main target of LTE for V2X isn’t necessarily to solve any problem [with DSRC], “but to create new business opportunity for cellular industry.”

DSRC vs. LTE V2X

Let’s break down the DSRC vs LTE V2X issue.

As Huawei’s Gan argued, the biggest advantage of LTE V2X is that it could reuse the existing cellular infrastructure and spectrum. Strategy Analytics’ Yang said, “Operator needs not to deploy dedicated road side unit (RSU) and apply dedicated spectrum.”

Meanwhile, DSRC is using IEEE 802.11p, essentially a half-clocked 802.11a system. It is an approved amendment to the IEEE 802.11 standard that adds wireless access in vehicular environments and communication systems. Calling DSRC essentially “a Wi-Fi based technology,” Yang said, “So in theory, LTE could provide better quality of service than DSRC.”

On the flip side, though, Yang said, “LTE-based V2X technology is more complex and the market size is smaller than Wi-Fi. Currently DSRC’s standard is ready now, but LTE V2X is still in study phase.” He added, “LTE could bring some enhancements but may generate new problems.”

Not everyone believes that LTE is a better way to go for V2X, especially when a crisis hits.

Nir Sasson, CEO of Autotalks, told EE Times,

“I was in Japan on March 11, 2011, when the great earthquake and tsunami

hit the nation. It took me more than 20 minutes to send a text message

to my wife.”

Recalling how cellular services in Japan ground to a halt, Sasson

said, “I don’t think we want to depend on the cellular network

infrastructure for V2X.”Autotalks has been working with STMicroelectronics to deliver V2X chipset families – one as a V2X complete, standalone solution and another as V2X hardware add-on solution. Autotalks said it will deliver a mass market-optimized V2X chipset for widespread deployment by 2017.

According to the LTE-V2X presentation by Huawei made at a July ITU Workshop in Beijing, LTE-V2X proponents pointed out several issues with 802.11p-based DSRC deployment.

They claim, for example, that performance “cannot be guaranteed, since 802.11p is an ad-hoc mechanism.” They also note that spectrum dedicated for V2V road safety is limited to 10MHz for the United States, and 30MHz for Europe. Aside from the cost of deploying roadside telematics units, they say the business model for DSRC isn’t clear and, perhaps more important, there is “no clear evolution path for future services.”

In contrast to DSRC, Huawei stresses that LTE-V2X, aside from reusing mobile network operator’s network infrastructure, is “one [LTE] chipset for all, allowing lower integration costs for car OEMs.”

The road to standardization

LTE-V2X still faces a long road to standardization, not to mention commercial deployment. Huawei’s timeline shows the LTE-V2X Study Item completing its work by the end of this year. The LTE-V2X Work Item begins in 2016.

The study at 3GPP (3rd Generation Partnership Project) is co-led by Huawei, LGE and CATT, a local telecom equipment manufacturer in China.

Noting that LTE V2X is still in its study phase in 3GPP, Strategy Analytics’ Yang told EE Times that after the study, it will become a Work Item in 3GPP Release 14 for formal standardization.

“According to the 3GPP schedule, the Release 14 standard should be completed in 2017. After the standard is done, it usually takes at least one year to produce a commercial chipset.”

Realistically speaking, “LTE V2X could not be available for commercial application until 2018 or even later,” he concluded.

Warm up to 5G

Leading the charge for LTE V2X are Qualcomm and Huawei. Smaller players such as LGE and CATT are also pushing it, observed Yang. He noted that big mobile network operators such as Deutsche Telecom and Orange (France) “are also happy to see the progress.”

Because LTE V2X is based on LTE-D2D, “Qualcomm is the major IPR owner,” said Yang. Other players, including Chinese companies, are “trying to enhance LTE-D2D in order to meet V2X requirements, in addition to decrease Qualcomm’s IPR share.”

Given the time needed for LTE V2X development, during which the cellular industry is presumably also busy discussing 5G, wouldn’t LTE V2X become a short-lived interim standard?

Yang noted, “It could be warm-up for 5G. Through the LTE V2X discussion, the cellular industry could prepare the necessary technical solutions (some of them could be reused in 5G), and build consensus within the industry as well as with the external partners.”

The level of support the development of LTE for V2X from carmakers remains unclear. Yang simply put, “I think it is just pushed by cellular industry.”

He explained, “Some automotive manufacturers have been involved in 5G research. For example, BMW is a partner of EU research project METIS (short for ‘Mobile and wireless communications Enablers for 2020 Information Society’) — which is a flagship research project for 5G. But I haven’t seen that they are eager for LTE V2X.”

http://www.eetimes.com/document.asp?_mc=RSS_EET_EDT&doc_id=1328030&page_number=1

No comments:

Post a Comment