Avago Technologies Ltd., which makes semiconductors for the

cellular, automotive and defense industries, agreed to buy wireless

chipmaker Broadcom Corp. for $37 billion in the biggest technology

acquisition ever.

Avago will pay $17 billion in cash and $20 billion in stock, the

companies said in a statement. The Singapore-based company’s offer

values Broadcom at $54.50 a share in cash, compared with a closing price

of $57.16 on Wednesday, when the stock rose the most since 2001 after

reports of an imminent deal. The offer is 16 percent above where

Broadcom’s shares closed Tuesday.

The stock fell 2.1 percent to $55.98 -- still above the offer price

-- at 10:48 a.m. in New York on Thursday. Avago’s shares rose less than 1

percent to $142.35.

The transaction is the biggest in the technology industry, according to data compiled by Bloomberg.

http://www.bloomberg.com/news/articles/2015-05-27/avago-said-near-deal-to-buy-wireless-chipmaker-broadcom

Thursday, May 28, 2015

Wednesday, May 27, 2015

Sandisk says its next solid state drives will have disk-like pricing

A decent terabyte mechanical drive can be purchased for between $60 and $100 depending on features and performance, while a similarly-sized SSD on the other hand will run in the range of $400 to $1,000 or more, a considerable jump that can make anyone think twice about how much they really need all their files and folders to be available at lightning quick speeds.

Now, a new SSD from SanDisk looks to challenge the status quo, and offer a flash-based drive at the same cost you’d pay for an HDD.

According to a recently released spec sheet, the Z400s will come in available storage flavors of 32GB, 64GB, 128GB and 256GB. The drives will be available as M.2 or 2.5-inch SATA and will supposedly offer sequential read/write speeds of 549 megabytes per second and 330MB/s, respectively.

We found that Intel’s PCI-E 750 Series SSD completely stomps that achievement at 1,226 MB/s read, though this result can be attributed almost entirely to the fact that it connects over PCI-E, rather than the slower SATA standard. Compared to other SSDs in general, though, the Sandisk Z400 series won’t be particularly slow — if it hits the quoted performance.

Related: Intel 750 Series SSD Review

The Z400s series will offer many of the advantages you’ve come to expect out of other SSDs, though the company says the cost will be just about on par with what you’d spend on a traditional hard disk.

This is the first time any SSD maker has been able to come close to creating a flash-based storage system that can keep pace with a standard mechanical hard drive in the pricing department.

Unfortunately, SanDisk is being tight-lipped about exactly how much the Z400s will cost or when it will be released. We’re skeptical that the company will be able to exactly match mechanical disk prices, but if they even come close it’ll be a big step forward for SSD affordability.

Tuesday, May 26, 2015

S. Korea takes up 75 pct of mobile DRAM market in Q1

SEOUL, May 26 (Yonhap) -- South Korean chip giants Samsung

Electronics Co. and SK hynix Inc. grabbed a record 75 percent share of

the global mobile dynamic random access memory (DRAM) market in the

first quarter on Samsung's stellar performance, data showed Tuesday.

Samsung, the world's top maker of mobile DRAMs, took up 52.1 percent of the global market in the January-March period with US$1.8 billion in revenue, up from 46.1 percent a quarter earlier, the data compiled by industry tracker TrendForce showed.

Samsung's smaller South Korean rival SK hynix accounted for 22.9 percent with $820 million, down 5.1 percentage points on-year.

Samsung's leap in the market share was attributed to strong sales of its 23-nanometer products.

"Samsung is currently mass producing 20nm and 23nm mobile DRAM, and the memory maker is leading the pack when it comes to LPDDR4 production and is the first to launch 6Gb and 8Gb products. In sum, Samsung's earning power will continue to grow," TrendForce said.

"SK hynix's mobile DRAM revenue decreased significantly in the first quarter. The supplier was hit especially hard by seasonality because it does not have a captive market as Samsung does," it added.

U.S.-based Micron Technology Inc. took up 22.6 percent of the DRAM market in the first quarter with a revenue of $809 million, slightly down from 23.3 percent posted a quarter earlier.

Taiwan-based Nanya Technology Corp. and Winbond Electronics Corp. held 1.4 percent and 0.9 percent each.

http://english.yonhapnews.co.kr/business/2015/05/26/12/0503000000AEN20150526002400320F.html

Samsung, the world's top maker of mobile DRAMs, took up 52.1 percent of the global market in the January-March period with US$1.8 billion in revenue, up from 46.1 percent a quarter earlier, the data compiled by industry tracker TrendForce showed.

Samsung's smaller South Korean rival SK hynix accounted for 22.9 percent with $820 million, down 5.1 percentage points on-year.

Samsung's leap in the market share was attributed to strong sales of its 23-nanometer products.

"Samsung is currently mass producing 20nm and 23nm mobile DRAM, and the memory maker is leading the pack when it comes to LPDDR4 production and is the first to launch 6Gb and 8Gb products. In sum, Samsung's earning power will continue to grow," TrendForce said.

"SK hynix's mobile DRAM revenue decreased significantly in the first quarter. The supplier was hit especially hard by seasonality because it does not have a captive market as Samsung does," it added.

U.S.-based Micron Technology Inc. took up 22.6 percent of the DRAM market in the first quarter with a revenue of $809 million, slightly down from 23.3 percent posted a quarter earlier.

Taiwan-based Nanya Technology Corp. and Winbond Electronics Corp. held 1.4 percent and 0.9 percent each.

http://english.yonhapnews.co.kr/business/2015/05/26/12/0503000000AEN20150526002400320F.html

Friday, May 22, 2015

Intel catches the wind with rooftop micro-turbine array

SANTA

CLARA -- Intel is turning the roof of its Santa Clara headquarters into a

mini-wind farm with what it says is one of the largest micro-turbine

arrays in the country.

The new array "is one of the largest we've identified anywhere," Sedler said. "One of the things Intel does that's a little different from other companies is that all the projects we have done to date have been on our campuses. It's not the answer, it's one of the answers. The key is to get off the grid."

http://www.mercurynews.com/business/ci_28164774/intel-catches-wind-rooftop-micro-turbine-array

Wednesday, May 20, 2015

LTE Direct being trialed by Qualcomm; allows smartphones to directly communicate

An emerging technology being trialed by Qualcomm and carrier partners

could ultimately undercut the need for new cell towers by enabling

smartphones to directly communicate with other smartphones.

The issue was front and center last month at the Founders Forum Smart Nation Singapore conference.

Steve Papa, founder of Parallel Wireless told CNBC that smartphones could eventually replace cell towers.

“There’s no reason why your cellphone isn’t the cell tower of the future,” he said. “We’re just on the cusp of chips coming out where a $300 chip can power an entire cell tower.”

In February, chipmaker Qualcomm put out a whitepaper based on its trials of LTE Direct, also called D2D, conducted with carrier Deutsche Telekom and Huawei.

From the whitepaper: “LTE Direct is a new and innovative device-to-device technology that enables discovering thousands of devices and their services in the proximity of [approximately]500 m, in a privacy-sensitive and battery-efficient way.”

If fully realized, the tech would autonomously discover other devices. “This horizontal discovery opens up a much broader network to app developers and users who do not need specific applications to receive value.”

LTE Direct uses licensed spectrum, which, in turn, would allow operators to use LTE Direct as a new way to provide apps and services to users.

The whitepaper authors wrote that LTE Direct “relies on the LTE physical layer to provide a scalable and universal framework for discovery and for connecting proximate peers.”

The technology was trialed by the two carriers and Qualcomm in Bonn, Germany, in September.

The Wireless Networking and Communications Group at The University of Texas-Austin is also conducting research into LTE Direct.

From research led by Professor Jeff Andrews, the group examined the promise of D2D.

“In principle, exploiting direct communication between nearby mobile devices will improve spectrum utilization, overall throughput and energy efficiency, while enabling new peer-to-peer and location-based applications and services. D2D-enabled LTE devices have the potential to become competitive for fallback public safety networks that must function when cellular networks are not available or fail.”

In the CNBC interview, Papa speculated as to the utility from smartphones equipped with LTE Direct.

“When you get that far, it’s not that much further to a scenario where when you’re finished with your cellphone, you can hang it on the wall and it adds to the cellular network.”

He also discussed the regulatory machinations associated with deployment of new spectrum.

“Who’s going to be in charge is more of a political than a technology or industry structure question. The reality is that technology will make spectrum less scarce. When spectrum is less scarce, there’s less of a need for a natural monopoly.”

http://www.rcrwireless.com/20150518/wireless/cell-towers-could-be-replaced-by-chips-tag17

The issue was front and center last month at the Founders Forum Smart Nation Singapore conference.

Steve Papa, founder of Parallel Wireless told CNBC that smartphones could eventually replace cell towers.

“There’s no reason why your cellphone isn’t the cell tower of the future,” he said. “We’re just on the cusp of chips coming out where a $300 chip can power an entire cell tower.”

In February, chipmaker Qualcomm put out a whitepaper based on its trials of LTE Direct, also called D2D, conducted with carrier Deutsche Telekom and Huawei.

From the whitepaper: “LTE Direct is a new and innovative device-to-device technology that enables discovering thousands of devices and their services in the proximity of [approximately]500 m, in a privacy-sensitive and battery-efficient way.”

If fully realized, the tech would autonomously discover other devices. “This horizontal discovery opens up a much broader network to app developers and users who do not need specific applications to receive value.”

LTE Direct uses licensed spectrum, which, in turn, would allow operators to use LTE Direct as a new way to provide apps and services to users.

The whitepaper authors wrote that LTE Direct “relies on the LTE physical layer to provide a scalable and universal framework for discovery and for connecting proximate peers.”

The technology was trialed by the two carriers and Qualcomm in Bonn, Germany, in September.

The Wireless Networking and Communications Group at The University of Texas-Austin is also conducting research into LTE Direct.

From research led by Professor Jeff Andrews, the group examined the promise of D2D.

“In principle, exploiting direct communication between nearby mobile devices will improve spectrum utilization, overall throughput and energy efficiency, while enabling new peer-to-peer and location-based applications and services. D2D-enabled LTE devices have the potential to become competitive for fallback public safety networks that must function when cellular networks are not available or fail.”

In the CNBC interview, Papa speculated as to the utility from smartphones equipped with LTE Direct.

“When you get that far, it’s not that much further to a scenario where when you’re finished with your cellphone, you can hang it on the wall and it adds to the cellular network.”

He also discussed the regulatory machinations associated with deployment of new spectrum.

“Who’s going to be in charge is more of a political than a technology or industry structure question. The reality is that technology will make spectrum less scarce. When spectrum is less scarce, there’s less of a need for a natural monopoly.”

http://www.rcrwireless.com/20150518/wireless/cell-towers-could-be-replaced-by-chips-tag17

Tuesday, May 19, 2015

Altera Rises on Report That Buyout Talks With Intel Resumed

Intel, the world’s largest chipmaker, has been looking for growth beyond the struggling personal-computer market. A resolution of the discussions with Altera is expected within a few weeks, the New York Post said, citing an unidentified person with direct knowledge of the talks.

Shares of Altera, which makes a broad range of low-power programmable semiconductors, jumped 5.7 percent to $46.93 at the close in New York, the highest price since July 7, 2011. The San Jose, California-based company had a market value of $14.1 billion.

Altera rejected an offer of about $54 a share from Intel last month, people familiar with the negotiations said at the time. Through May 15, the stock had gained 2.5 percent since reports that the talks broke off, signaling that investors were anticipating the discussions may resume.

Acquiring Altera may help Intel defend and extend its most profitable business: supplying server chips used in data centers. While sales of chips for PCs are declining as more consumers rely on tablets and smartphones to get online, the data centers needed to churn out information and services for those mobile devices are driving orders for higher-end Intel processors and shoring up profitability. Sales at Intel’s data-center division rose 19 percent in the first quarter as Internet companies such as Google Inc. and Facebook Inc. built out their server operations.

Intel’s stock rose 1.3 percent to $33.41.

Chuck Mulloy, a spokesman for Santa Clara, California-based Intel, declined to comment. Altera representatives couldn’t be reached.

http://www.bloomberg.com/news/articles/2015-05-18/altera-rises-after-report-that-buyout-talks-with-intel-resumed

Monday, May 18, 2015

Integrated Silicon says expects to hold talks with Cypress Semi

May 15 Integrated Silicon Solution Inc said on Friday it expected to hold talks with Cypress Semiconductor Corp regarding a buyout offer from its fellow chipmaker.

Cypress has offered to buy Integrated Silicon Solution for $19.75 per share, valuing the company at $627.3 million.

Integrated Silicon has already agreed to a $19.25 per share offer from a Chinese consortium led by Summitview Capital.

Integrated Silicon Solution said on Friday it was not withdrawing its support for the Summitview Capital deal. (Reporting by Devika Krishna Kumar in Bengaluru; Editing by Saumyadeb Chakrabarty)

http://www.reuters.com/article/2015/05/15/integrated-silic-ma-cypress-semicond-idUSL3N0Y664820150515

Friday, May 15, 2015

Silicon Chips That See Are Going to Make Your Smartphone Brilliant

Many gadgets will be able to understand images and video thanks to

chips designed to run powerful artificial-intelligence algorithms.

- By Tom Simonite on May 14, 2015

Companies like Google have made breakthroughs in image and face recognition through deep learning, using giant data sets and powerful computers (see “10 Breakthrough Technologies 2013: Deep Learning”). Now two leading chip companies and the Chinese search giant Baidu say hardware is coming that will bring the technique to phones, cars, and more.

Chip manufacturers don’t typically disclose their new features in advance. But at a conference on computer vision Tuesday, Synopsys, a company that licenses software and intellectual property to the biggest names in chip making, showed off a new image-processor core tailored for deep learning. It is expected to be added to chips that power smartphones, cameras, and cars. The core would occupy about one square millimeter of space on a chip made with one of the most commonly used manufacturing technologies.

Pierre Paulin, a director of R&D at Synopsys, told MIT Technology Review that the new processor design will be made available to his company’s customers this summer. Many have expressed strong interest in getting hold of hardware to help deploy deep learning, he said.

Synopsys showed a demo in which the new design recognized speed-limit signs in footage from a car. Paulin also presented results from using the chip to run a deep-learning network trained to recognize faces. It didn’t hit the accuracy levels of the best research results, which have been achieved on powerful computers, but it came pretty close, he said. “For applications like video surveillance it performs very well,” he said. The specialized core uses significantly less power than a conventional chip would need to do the same task.

The new core could add a degree of visual intelligence to many kinds of devices, from phones to cheap security cameras. It wouldn’t allow devices to recognize tens of thousands of objects on their own, but Paulin said they might be able to recognize dozens.

That might lead to novel kinds of camera or photo apps. Paulin said the technology could also enhance car, traffic, and surveillance cameras. For example, a home security camera could start sending data over the Internet only when a human entered the frame. “You can do fancier things like detecting if someone has fallen on the subway,” he said.

Jeff Gehlhaar, vice president of technology at Qualcomm Research, spoke at the event about his company’s work on getting deep learning running on apps for existing phone hardware. He declined to discuss whether the company is planning to build support for deep learning into its chips. But speaking about the industry in general, he said that such chips are surely coming. Being able to use deep learning on mobile chips will be vital to helping robots navigate and interact with the world, he said, and to efforts to develop autonomous cars.

“I think you will see custom hardware emerge to solve these problems,” he said. “Our traditional approaches to silicon are going to run out of gas, and we’ll have to roll up our sleeves and do things differently.” Gehlhaar didn’t indicate how soon that might be. Qualcomm has said that its coming generation of mobile chips will include software designed to bring deep learning to camera and other apps (see “Smartphones Will Soon Learn to Recognize Faces and More”).

Ren Wu, a researcher at Chinese search company Baidu, also said chips that support deep learning are needed for powerful research computers in daily use. “You need to deploy that intelligence everywhere, at any place or any time,” he said.

Being able to do things like analyze images on a device without connecting to the Internet can make apps faster and more energy-efficient because it isn’t necessary to send data to and fro, said Wu. He and Qualcomm’s Gehlhaar both said that making mobile devices more intelligent could temper the privacy implications of some apps by reducing the volume of personal data such as photos transmitted off a device.

“You want the intelligence to filter out the raw data and only send the important information, the metadata, to the cloud,” said Wu.

http://www.technologyreview.com/news/537446/silicon-chips-that-see-are-going-to-make-your-smartphone-brilliant/

Thursday, May 14, 2015

Cypress Semiconductor offers to buy Integrated Silicon Solution

Chipmaker Cypress Semiconductor Corp (CY.O) said it offered to buy Integrated Silicon Solution Inc (ISSI.O) for $19.75 per share in cash, trumping an offer by a Chinese consortium led by Summitview Capital.

Cypress's cash offer values Integrated Silicon Solution at $627.3 million, based on about 31.8 million shares outstanding as of May 1, according to Thomson Reuters data.

The offer is at a 5.4 percent premium to the stock's Wednesday close.

If the deal goes through, it will help Cypress continue to shift focus to automotive customers.

The company agreed to buy peer Spansion Inc for $1.59 billion in stock in December to help it shrug off weakness in the smartphone market.

Spansion's microcontroller chips are used for everything from controlling airbag deployment in cars to rolling down windows.

"Cypress bought Spansion partly due to an explosion in the automotive sector and ISSI has about half its revenue coming from automotive today," Craig Hallum analyst Richard Shannon told Reuters.

The Chinese consortium had agreed to buy Integrated Silicon for $19.25 per share in cash in March.

Integrated Silicon said in April that it would hold a special shareholder meeting on June 3 to consider the consortium's proposal.

Integrated Silicon Solution's shares rose 6.7 percent to $20 in after-market trading on Wednesday, while Cypress' shares rose nearly 2 percent to $12.89.

http://www.reuters.com/article/2015/05/13/us-integrated-silic-m-a-cypress-semicond-idUSKBN0NY2N020150513

Wednesday, May 13, 2015

Investigation eyes defense equipment defects

The Yomiuri Shimbun

The Defense Ministry will conduct a far-reaching investigation into its

supply chain to check whether defective parts have been incorporated in

radar systems and other equipment used by the Self-Defense Forces, The

Yomiuri Shimbun has learned.

The ministry has decided more stringent quality management of components used in defense equipment is necessary after revelations that defective parts thought to have been made in China have caused problems in U.S. military systems.

The tentatively named “defense equipment agency” that will be established around October will conduct the investigation beginning in this fiscal year in cooperation with major manufacturers that supply the parts and procure them from subcontractors.

According to a senior Defense Ministry official, the investigation is likely to cover equipment containing many electronic components, such as radar systems, guided missiles and aircraft.

Production of such equipment often involves many companies hired as

subcontractors and sub-subcontractors, and new parts are continually

being developed. As a result, even major manufacturers that win

contracts with the ministry can, at times, struggle to accurately grasp

what kind of parts are installed in certain components.The ministry has decided more stringent quality management of components used in defense equipment is necessary after revelations that defective parts thought to have been made in China have caused problems in U.S. military systems.

The tentatively named “defense equipment agency” that will be established around October will conduct the investigation beginning in this fiscal year in cooperation with major manufacturers that supply the parts and procure them from subcontractors.

According to a senior Defense Ministry official, the investigation is likely to cover equipment containing many electronic components, such as radar systems, guided missiles and aircraft.

The agency’s investigation will check what types of parts are used and how they are made. Agency officials will do this by methods including questioning companies involved in the manufacturing process.

This is designed to flush out glitches that could cause malfunctions, as well as detect the presence of spyware that would pilfer information from computer systems.

The ministry has already launched a priority review of components used in some equipment, and is considering what steps to take if any defective parts are confirmed. The ministry also expects the investigation will help prevent information about important Japanese defense technologies from being leaked overseas.

The distribution of parts used in defense equipment is becoming more internationalized, and managing the risks inherent in this process is growing in importance.

In 2008, a massive number of shoddy parts thought to have been produced in China found their way into computer systems used by the U.S. Air Force and other entities in the United States, and caused fires, system failures and other problems. In 2012, the U.S. Senate Armed Services Committee announced it had found about 1,800 cases of used components being passed off as brand-new parts for U.S. military equipment. In total, these cases involved more than 1 million bogus parts, which had been used in equipment including missile defense systems. The committee’s report called on the U.S. government to take countermeasures including establishing a system under which companies would be required to pay for replacing the faulty parts.

This U.S. case was one factor behind the Defense Ministry’s decision to initiate an investigation into the supply chain for Japanese defense equipment.Speech

http://the-japan-news.com/news/article/0002134324

A Standards-Based Way To Avoid Counterfeit Electronic Parts

Global IC Trading Group’s Lori LeRoy and IEC Electronics' Mark Northrup co-presented on April 22, 2015 at the ERAI Summit "Supply Chain Security: A Moving Target".

This presentation was part of the Training Track “A Standards-Based Way To Avoid Counterfeit Electronic Parts” and Ms. LeRoy and Mr. Northrup presenting based on a sellers perspective on how to avoid the acceptance of counterfeit components. The title of the Presentation was “EMS Supply Chain Security Timeline: Past, Present and Future” which discussed changes throughout the Independent Distribution Industry over the last 8 years, including the necessity of inspection equipment, training and certifications to perform detailed component inspections utilizing X-Ray, XRF and decapsulation. All product at Global IC Trading Group goes through a very thorough inspection and customers are provided a detailed inspection report with each order. Throughout the presentation, Global IC Trading’s capabilities were examined and proven to be leading edge and what is needed to be a trusted supplier in today's market. To learn more about Global IC Trading Group, visit www.gictg.com

Tuesday, May 12, 2015

PLX part number # PEX8525-AA25BI G in stock and available to ship today!

PLX part number # PEX8525-AA25BI G 600 pcs with a date code of 0818 are in stock and available to ship today!

Call Paul Meyers at 949-421-1141 or email pmeyers@gictg.com

Visit our website at www.gictg.com

Call Paul Meyers at 949-421-1141 or email pmeyers@gictg.com

Visit our website at www.gictg.com

Samsung only chipmaker to expand capex in 2015: sources

SEOUL, May 12 (Yonhap) --- Samsung Electronics Co., South Korea's top

tech giant, is expected to become the only major chipmaker around the

globe to expand facility investment this year, industry sources said

Tuesday.

According to the sources, global industry leader Intel Corp. is expected to allocate US$8.7 billion to facility investment this year, down $1.3 billion from 2014.

Taiwan Semiconductor Manufacturing Co. (TSMC) is also expected to slash the amount by $1 billion to $10.5 billion this year.

In contrast, Samsung announced in January that it will expand capital expenditures this year, though it failed to disclose by how much.

Last week, Samsung made strides to solidify its chip sector this yea by breaking ground on its new chip-production line in Pyeongtaek, some 70 kilometers south of Seoul.

Scheduled to be ready for production in the first half of 2017, Samsung will pump in 15.6 trillion won (US$14.2 billion) for the first phase of the project, marking its largest-ever investment in a single production line.

The South Korean tech giant spent 7.2 trillion won in its facility investment in the first quarter of 2015, with the chip segment accounting for 4.4 trillion won. At least 15 trillion won will be spent on the area by the end of this year, industry watchers said.

Last year, Samsung spent 23.4 trillion won on new equipment and plants, 60 percent of which went to the chip sector.

Samsung, meanwhile, has recently commenced mass production of the most advanced mobile application processor that incorporates 14-nanometer FinFET technology, narrowing gaps with TSMC in the foundry segment.

http://english.yonhapnews.co.kr/business/2015/05/12/30/0503000000AEN20150512001000320F.html

According to the sources, global industry leader Intel Corp. is expected to allocate US$8.7 billion to facility investment this year, down $1.3 billion from 2014.

Taiwan Semiconductor Manufacturing Co. (TSMC) is also expected to slash the amount by $1 billion to $10.5 billion this year.

In contrast, Samsung announced in January that it will expand capital expenditures this year, though it failed to disclose by how much.

Last week, Samsung made strides to solidify its chip sector this yea by breaking ground on its new chip-production line in Pyeongtaek, some 70 kilometers south of Seoul.

Scheduled to be ready for production in the first half of 2017, Samsung will pump in 15.6 trillion won (US$14.2 billion) for the first phase of the project, marking its largest-ever investment in a single production line.

The South Korean tech giant spent 7.2 trillion won in its facility investment in the first quarter of 2015, with the chip segment accounting for 4.4 trillion won. At least 15 trillion won will be spent on the area by the end of this year, industry watchers said.

Last year, Samsung spent 23.4 trillion won on new equipment and plants, 60 percent of which went to the chip sector.

Samsung, meanwhile, has recently commenced mass production of the most advanced mobile application processor that incorporates 14-nanometer FinFET technology, narrowing gaps with TSMC in the foundry segment.

http://english.yonhapnews.co.kr/business/2015/05/12/30/0503000000AEN20150512001000320F.html

Friday, May 8, 2015

Marvel P/N 88E3081-RAF - 1817 pcs in stock

Marvel P/N 88E3081-RAF - 1817 pcs in stock

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Lattice P/N LCMXO2280C-3TN100C - 1717 pcs in stock

Lattice P/N LCMXO2280C-3TN100C - 1717 pcs in stock

0801 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

0801 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

PMC P/N PM8354-NGI - 388 pcs in stock

PMC P/N PM8354-NGI - 388 pcs in stock

0943 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

0943 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Conexant P/N CX25870-14 - 168 pcs in stock

Conexant P/N CX25870-14 - 168 pcs in stock

0731 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

0731 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Molex P/N 55359-5029 - 1650 pcs in stock

Molex P/N 55359-5029 - 1650 pcs in stock

1017 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

1017 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Analog Devices P/N ADV7401BSTZ-80 - 1016 pcs in stock

Analog Devices P/N ADV7401BSTZ-80 - 1016 pcs in stock

08+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

08+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

TI P/N TMS320LC203PZA - 7544 pcs in stock

TI P/N TMS320LC203PZA - 7544 pcs in stock

00+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

00+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Maxim P/N MAX3982UTE+T - 3931 pcs in stock

Maxim P/N MAX3982UTE+T - 3931 pcs in stock

07+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

07+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

National Semi P/N LMX2330ATMX - 7500 pcs in stock

National Semi P/N LMX2330ATMX - 7500 pcs in stock

98+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

98+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

IR P/N IRG4PH50SPBF - 1399 pcs in stock

IR P/N IRG4PH50SPBF - 1399 pcs in stock

10+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

10+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Atech P/N ATS-273B - 50,000 pcs in stock

Atech P/N ATS-273B - 50,000 pcs in stock

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

AVX P/N TPSD477M004S0045 - 20,000 pcs in stock

AVX P/N TPSD477M004S0045 - 20,000 pcs in stock

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Bell Fuse P/N VRAE-06E1AQG - 1369 pcs in stock

Bell Fuse P/N VRAE-06E1AQG - 1369 pcs in stock

0844 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

0844 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Broadcom P/N BCM5715SKPBG - 2061 pcs in stock

Broadcom P/N BCM5715SKPBG - 2061 pcs in stock

0846 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

0846 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Burr Brown P/N REF102AU - 917 pcs in stock

Burr Brown P/N REF102AU - 917 pcs in stock

0436 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

0436 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Cypress P/N IMIC9531CTT - 1784 pcs in stock

Cypress P/N IMIC9531CTT - 1784 pcs in stock

0613 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

0613 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Glenair P/N 103-009-016 - 20 pcs in stock

Glenair P/N 103-009-016 - 20 pcs in stock

0642 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

0642 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

IMS P/N 166 42 2520 001 - 2480 pcs in stock

IMS P/N 166 42 2520 001 - 2480 pcs in stock

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Laird P/N 0077001002 - 4000 pcs in stock

Laird P/N 0077001002 - 4000 pcs in stock

2004+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

2004+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Lattice P/N ISPGAL22V10AV-75LSN - 29,027 pcs in stock

Lattice P/N ISPGAL22V10AV-75LSN - 29,027 pcs in stock

2010+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

2010+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Littlefuse P/N P3100SBRP - 50,000 pcs in stock

Littlefuse P/N P3100SBRP - 50,000 pcs in stock

0248 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

0248 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Maxim P/N MAX1954EUB+T - 2500 pcs in stock

Maxim P/N MAX1954EUB+T - 2500 pcs in stock

0838 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

0838 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Maxim P/N MAX3243EUI+T - 1770 pcs in stock

Maxim P/N MAX3243EUI+T - 1770 pcs in stock

0645 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

0645 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Toshiba P/N 2SC1959-Y - 6000 pcs in stock

Toshiba P/N 2SC1959-Y - 6000 pcs in stock

01+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Toshiba P/N 2SC1959-Y - 6,000 pcs in stock

Toshiba P/N 2SC1959-Y - 6,000 pcs in stock

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Micrel P/N MIC2169BMM - 150,000 pcs in stock

Micrel P/N MIC2169BMM - 150,000 pcs in stock

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Mitsubishi P/N M51957AFP-600D - 9000 pcs in stock

Mitsubishi P/N M51957AFP-600D - 9000 pcs in stock

98+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

98+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Molex P/N 54132-4092 - 3000 pcs in stock

Molex P/N 54132-4092 - 3000 pcs in stock

03+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

03+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Molex P/N 84700-0002 - 581 pcs in stock

Molex P/N 84700-0002 - 581 pcs in stock

06+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

06+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Maxim P/N MAX798ESE - 1000 pcs in stock

Maxim P/N MAX798ESE - 1000 pcs in stock

9817 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

9817 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Motorola P/N MC68020RP20 - 309 pcs in stock

Motorola P/N MC68020RP20 - 309 pcs in stock

96+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

National Semi P/N LMX2326TM - 3158 pcs in stock

National Semi P/N LMX2326TM - 3158 pcs in stock

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

NEC P/N PS2701-1-F3 - 10,500 pcs in stock

NEC P/N PS2701-1-F3 - 10,500 pcs in stock

00+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

00+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

NEC P/N UPC2712TB-E3 - 24,000 pcs in stock

NEC P/N UPC2712TB-E3 - 24,000 pcs in stock

00+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

NEC P/N PS2701-1-E3 - 30,600 pcs in stock

NEC P/N PS2701-1-E3 - 30,600 pcs in stock

00+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

00+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

On-Semi P/N MC100EPT23D - 1920 pcs in stock

On-Semi P/N MC100EPT23D - 1920 pcs in stock

1413 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Maxim P/N ADADC71KD - 45,000 pcs in stock

Maxim P/N ADADC71KD - 45,000 pcs in stock

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Panasonic P/N EEVFC1C100R - 300,000 pcs in stock

Panasonic P/N EEVFC1C100R - 300,000 pcs in stock

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

PowerOne P/N EMS15DE-N - 206 pcs in stock

PowerOne P/N EMS15DE-N - 206 pcs in stock

06+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Raychem P/N RXE020 - 250 pcs in stock

Raychem P/N RXE020 - 250 pcs in stock

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Semtech P/N ADADC71KD - 39,000 pcs in stock

Semtech P/N ADADC71KD - 39,000 pcs in stock

06+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Spansion P/N AM29F800BT-70EF - 2880 pcs in stock

Spansion P/N AM29F800BT-70EF - 2880 pcs in stock

1036 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Switchcraft P/N RAPC712 - 150,000 pcs in stock

Switchcraft P/N RAPC712 - 150,000 pcs in stock

04+ DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Analog Devices P/N ADADC71KD - 110 pcs in stock

Analog Devices P/N ADADC71KD - 110 pcs in stock

1037 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

1037 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Microchip Technology to Buy Micrel

http://www.wsj.com/articles/microchip-technology-to-buy-micrel-1431035341

Thursday, May 7, 2015

Samsung readies new processors to power the Internet of Things

Samsung's bet on the Internet of Thing is about to get a little smaller -- physically, that is.

The South Korean electronics giant on Tuesday plans to reveal new chip platforms to power Internet-connected devices, ranging from wearables to smart washing machines, sources tell CNET. The new hardware will be called Artik, said a person who didn't want to be named in talking about a product that's not yet announced, and it comes from Samsung's Menlo Park, Calif.-based Strategy and Innovation Center.

The group -- which is led by Young Sohn, president and chief strategy officer of Samsung Electronics -- has been tasked with seeking new technology, partnerships and investments in hardware, generally with a longer-term view. Sohn, who launched a $100 million US investment fund for Samsung in early 2013, has seen his role expand in recent months to include oversight over more of Samsung's investments and its research and development. In total, Samsung has allocated more than $1 billion to fund US startups.

Sohn will introduce Artik during a keynote at the Internet of Things World conference on Tuesday in San Francisco. In a press release about the keynote, Samsung has said it "will reveal a major company milestone that will enable the new wave of groundbreaking IoT devices and services. The event will bring together industry leaders, entrepreneurs, developers and emerging companies to discuss the future of IoT and its profound implications."

"By

continuing efforts to connect devices and people to achieve greater

insights, we have a huge opportunity to work with others in the

industry, to tackle these real-world issues in ways that will

fundamentally change people's lives for the better," Sohn said in the

press release.

Samsung has been making a big bet on the Internet of Things, the concept of using sensors and other technologies to hook just about anything you can think of into the Internet. Analyst firm Gartner predicts the number of networked devices will surge to 26 billion units by 2020 from about 900 million in 2009, turning formerly "dumb" objects into smart ones that can communicate with each other. IDC reckons the IoT market will hit $3.04 trillion that same year.

Last August, Samsung acquired smart-home startup SmartThings to help with its push. SmartThings' technology helps consumers to control their appliances from their smartphones, smartwatches and other devices, and it has been viewed as key to Samsung's smart-home and Internet of Things efforts.

During the 2015 Consumer Electronics Show in January, Samsung, led by co-CEO Boo-Keun Yoon, vowed that all of the company's products would be built on platforms that are open and compatible with other products. Yoon said that that 90 percent of its devices -- which range from smartphones to refrigerators -- would be able to connect to the Web by 2017. In five years, every product in the company's entire catalog is expected to be Internet-connected.

But Artik won't just be targeted at Samsung's own appliances. Instead, other device makers will be able to use the chips in their products.

Artik is the second product to come from Young's innovation initiative in the past year. In May 2014, the group revealed new open software and a so-called reference design hardware to better measure certain health characteristics of wearables users, including heart rate and blood pressure. Its Simband

fitness band reference design -- a template describing how a particular

technology should work -- incorporates a new sensor module that can be

used in future wearables, while a cloud-based software platform called

Samsung Architecture for Multimodal Interactions, or SAMI, can collect

sensor data from the devices for analysis.

As Samsung's core mobile business continues to struggle, the company is counting on its other businesses -- such as home appliances and semiconductors -- to boost its profits. Samsung is the world's biggest maker of memory chips and also manufactures application processors that serve as the brains of devices, including many of Apple's iPhones. The company's new Galaxy S6 and S6 Edge smartphones use Samsung's Exynos applications processor instead of a Qualcomm chip, as well as Samsung-made flash memory and the wireless chip that connects the phone to 3G and 4G networks.

Samsung largely targets Exynos at its own devices, and essentially no other companies buy the processors. But selling Artik to other device makers could give Samsung a boost. It also puts Samsung in fiercer competition with chipmakers such as Intel and Qualcomm, which make their profits from supplying processors, not the devices that use them. All of the companies have been looking to wearables and the Internet of Things as new areas of growth.

Intel, for instance, in January revealed a processor platform for wearables, dubbed Curie. The button-sized device includes a processor, Bluetooth low-energy radio, sensors and a dedicated engine to determine different sporting activity. It's also able to run for extended periods with a coin-size battery, or can be recharged. Such a minuscule chip could power wearables of different designs, from rings to pendants to clothes. Curie and Samsung's Artik may be competing for many of the same customers.

http://www.cnet.com/news/samsung-readies-new-processors-to-power-the-internet-of-things/

The South Korean electronics giant on Tuesday plans to reveal new chip platforms to power Internet-connected devices, ranging from wearables to smart washing machines, sources tell CNET. The new hardware will be called Artik, said a person who didn't want to be named in talking about a product that's not yet announced, and it comes from Samsung's Menlo Park, Calif.-based Strategy and Innovation Center.

The group -- which is led by Young Sohn, president and chief strategy officer of Samsung Electronics -- has been tasked with seeking new technology, partnerships and investments in hardware, generally with a longer-term view. Sohn, who launched a $100 million US investment fund for Samsung in early 2013, has seen his role expand in recent months to include oversight over more of Samsung's investments and its research and development. In total, Samsung has allocated more than $1 billion to fund US startups.

Sohn will introduce Artik during a keynote at the Internet of Things World conference on Tuesday in San Francisco. In a press release about the keynote, Samsung has said it "will reveal a major company milestone that will enable the new wave of groundbreaking IoT devices and services. The event will bring together industry leaders, entrepreneurs, developers and emerging companies to discuss the future of IoT and its profound implications."

Samsung has been making a big bet on the Internet of Things, the concept of using sensors and other technologies to hook just about anything you can think of into the Internet. Analyst firm Gartner predicts the number of networked devices will surge to 26 billion units by 2020 from about 900 million in 2009, turning formerly "dumb" objects into smart ones that can communicate with each other. IDC reckons the IoT market will hit $3.04 trillion that same year.

Last August, Samsung acquired smart-home startup SmartThings to help with its push. SmartThings' technology helps consumers to control their appliances from their smartphones, smartwatches and other devices, and it has been viewed as key to Samsung's smart-home and Internet of Things efforts.

During the 2015 Consumer Electronics Show in January, Samsung, led by co-CEO Boo-Keun Yoon, vowed that all of the company's products would be built on platforms that are open and compatible with other products. Yoon said that that 90 percent of its devices -- which range from smartphones to refrigerators -- would be able to connect to the Web by 2017. In five years, every product in the company's entire catalog is expected to be Internet-connected.

But Artik won't just be targeted at Samsung's own appliances. Instead, other device makers will be able to use the chips in their products.

As Samsung's core mobile business continues to struggle, the company is counting on its other businesses -- such as home appliances and semiconductors -- to boost its profits. Samsung is the world's biggest maker of memory chips and also manufactures application processors that serve as the brains of devices, including many of Apple's iPhones. The company's new Galaxy S6 and S6 Edge smartphones use Samsung's Exynos applications processor instead of a Qualcomm chip, as well as Samsung-made flash memory and the wireless chip that connects the phone to 3G and 4G networks.

Samsung largely targets Exynos at its own devices, and essentially no other companies buy the processors. But selling Artik to other device makers could give Samsung a boost. It also puts Samsung in fiercer competition with chipmakers such as Intel and Qualcomm, which make their profits from supplying processors, not the devices that use them. All of the companies have been looking to wearables and the Internet of Things as new areas of growth.

Intel, for instance, in January revealed a processor platform for wearables, dubbed Curie. The button-sized device includes a processor, Bluetooth low-energy radio, sensors and a dedicated engine to determine different sporting activity. It's also able to run for extended periods with a coin-size battery, or can be recharged. Such a minuscule chip could power wearables of different designs, from rings to pendants to clothes. Curie and Samsung's Artik may be competing for many of the same customers.

http://www.cnet.com/news/samsung-readies-new-processors-to-power-the-internet-of-things/

Wednesday, May 6, 2015

Intel's 18-core Xeon chips tuned for machine learning, analytics

Smaller servers are taking over data centers, but Intel believes the future is also bright for powerful

big-iron servers, thanks to companies' embrace of machine learning,

which requires a lot of horsepower to process complex algorithms and

large data sets.

With its new top-line Xeon E7 v3 server chips based on the Haswell microarchitecture, Intel hopes to capitalize on the demand for this type of server. With up to 18 CPU cores, the chips are Intel's fastest, and designed for databases, ERP (enterprise resource planning) systems and analytics related to machine learning.

Complex machine learning models can't be distributed over the cloud or a set of smaller hyperscale servers in a data center. Instead, a more powerful cluster of servers is needed to run deep-learning systems, where the larger number of cores could power more precise analysis of oceans of data.

"To create an algorithm to look across thousands of genomes, and to look for correlations, is not the sort of workload that existed a few years ago," said Ron Kasabian, general manager of Big Data Solutions at Intel.

Intel is adapting the E7 chips to a fast-changing server market, where companies like Google, Facebook and Amazon have redefined data center designs. Those companies build mega-data centers around single or two-socket servers which are cheap and can be installed by the hundreds to handle the ever-growing data traffic.

The E7 chips are targeted at more powerful servers with four or more sockets, which don't typically fit in the Web hosting or hyperscale profile. These are typically servers used for databases and ERP, and companies are also using them for analytics to make better business projections and decisions.

Cloud servers or distributed computing environments -- like a Hadoop installation -- can tap into these powerful clusters to quickly extract information and then serve it to customers over the Internet. A large amount of data is being fed to smaller servers and appliances with more users coming online and the expansion of Internet of Things devices. The information can be sent back to the big-iron servers, which can analyze and help make sense of the information.

Intel has partnered with SAP to adapt the software company's applications to the E7 v3 chips. The companies claim the new chips are six times faster on leading enterprise applications than the Xeon E7 v2, which shipped last year and was based on the older Ivy Bridge architecture. The performance improvements come from chip improvements and SAP's software optimizations.

The Xeon E7 v3 chip, code-named Haswell-EX, has many new technologies such as DDR4 DRAM, a faster and more power-efficient form of memory which could enhance overall server performance. It supports 1.5TB of memory per socket, so an eight-socket server could host a mammoth 12TB of memory, which is useful for in-memory applications like databases.

The CPU is about up to 40 percent faster than its predecessor, said Matt Lane, Xeon E7 product line manager of Intel's Data Center Group.

Intel's architecture is becoming more flexible, and the company could create derivatives of the Xeon E7 v3 personalized for specific customers that may order chips in bulk, Lane said. Intel has already customized some previous Xeon E7 v2 chips to run faster with Oracle databases.

Dell, Hewlett-Packard and Lenovo are among a handful of companies launching servers with the new chips.

Intel's new E7 chips include four 18-core chips and eight chips with four to 16 cores. The fastest chip is the E7-8890v3, which runs at 2.5GHz, has 45MB of cache and is priced at US$7,175. The entry-level eight-core E7-4809v3 has a clock speed of 2.0GHz, 20MB of cache, and is the cheapest of the new offerings at $1,224.

http://www.pcadvisor.co.uk/news/enterprise/3610660/intels-18-core-xeon-chips-tuned-for-machine-learning-analytics/

With its new top-line Xeon E7 v3 server chips based on the Haswell microarchitecture, Intel hopes to capitalize on the demand for this type of server. With up to 18 CPU cores, the chips are Intel's fastest, and designed for databases, ERP (enterprise resource planning) systems and analytics related to machine learning.

Complex machine learning models can't be distributed over the cloud or a set of smaller hyperscale servers in a data center. Instead, a more powerful cluster of servers is needed to run deep-learning systems, where the larger number of cores could power more precise analysis of oceans of data.

"To create an algorithm to look across thousands of genomes, and to look for correlations, is not the sort of workload that existed a few years ago," said Ron Kasabian, general manager of Big Data Solutions at Intel.

Intel is adapting the E7 chips to a fast-changing server market, where companies like Google, Facebook and Amazon have redefined data center designs. Those companies build mega-data centers around single or two-socket servers which are cheap and can be installed by the hundreds to handle the ever-growing data traffic.

The E7 chips are targeted at more powerful servers with four or more sockets, which don't typically fit in the Web hosting or hyperscale profile. These are typically servers used for databases and ERP, and companies are also using them for analytics to make better business projections and decisions.

Cloud servers or distributed computing environments -- like a Hadoop installation -- can tap into these powerful clusters to quickly extract information and then serve it to customers over the Internet. A large amount of data is being fed to smaller servers and appliances with more users coming online and the expansion of Internet of Things devices. The information can be sent back to the big-iron servers, which can analyze and help make sense of the information.

Intel has partnered with SAP to adapt the software company's applications to the E7 v3 chips. The companies claim the new chips are six times faster on leading enterprise applications than the Xeon E7 v2, which shipped last year and was based on the older Ivy Bridge architecture. The performance improvements come from chip improvements and SAP's software optimizations.

The Xeon E7 v3 chip, code-named Haswell-EX, has many new technologies such as DDR4 DRAM, a faster and more power-efficient form of memory which could enhance overall server performance. It supports 1.5TB of memory per socket, so an eight-socket server could host a mammoth 12TB of memory, which is useful for in-memory applications like databases.

The CPU is about up to 40 percent faster than its predecessor, said Matt Lane, Xeon E7 product line manager of Intel's Data Center Group.

Intel's architecture is becoming more flexible, and the company could create derivatives of the Xeon E7 v3 personalized for specific customers that may order chips in bulk, Lane said. Intel has already customized some previous Xeon E7 v2 chips to run faster with Oracle databases.

Dell, Hewlett-Packard and Lenovo are among a handful of companies launching servers with the new chips.

Intel's new E7 chips include four 18-core chips and eight chips with four to 16 cores. The fastest chip is the E7-8890v3, which runs at 2.5GHz, has 45MB of cache and is priced at US$7,175. The entry-level eight-core E7-4809v3 has a clock speed of 2.0GHz, 20MB of cache, and is the cheapest of the new offerings at $1,224.

http://www.pcadvisor.co.uk/news/enterprise/3610660/intels-18-core-xeon-chips-tuned-for-machine-learning-analytics/

Tuesday, May 5, 2015

GE ties up with Qualcomm, Apple in new lighting business bet

General Electric Co on Monday announced collaborations with Qualcomm Inc and Apple Inc as it uses digital technology and the growing appetite for data to reinvigorate its 130-year-old lighting business.

With chipmaker Qualcomm, GE is offering retailers a way to connect with shoppers' smartphones through technology embedded in LED light bulbs, the company said. One use of the "indoor positioning" technology could be to transmit customized coupons to shoppers depending on their store location.

GE also said it will produce an LED bulb compatible with Apple's yet-to-launch connected-device platform HomeKit. The bulb can change colors to align with the natural rhythms of the body.

ADVERTISING

While GE sees an opportunity in selling energy-efficient LED bulbs, it will seek to use sensors and other technology embedded in LEDs to the advantage of consumers, businesses and cities, said Beth Comstock, who leads GE Business Innovations.

Services offered by GE stand to provide revenue that could offset pressure should the LED bulb business become more commoditized.

"There’s now a data stream from light that is going to create opportunity to be more productive," said Comstock, in her first interview about the lighting strategy since September, when the unit became part of GE's innovations division.

GE itself is undergoing a sweeping overhaul, jettisoning the bulk of its finance division to focus on big-ticket industrial products such as jet engines and power turbines.

Some analysts have speculated the U.S. conglomerate will divest lighting after deciding last year to sell its appliances segment and moves by Siemens and Philips to hive off lighting units. GE Lighting totaled about $2.5 billion in revenue last year, 2.3 percent of the company's overall industrial sales.

Comstock said lighting fits smoothly with GE Chief Executive Jeff Immelt's desire to marry software and analytics with GE's various industrial equipment, which GE calls the "Industrial Internet."

"LEDs plus software, it helps GE continue its Industrial Internet expansion and I think the lighting business has a big role in GE's future because of that," Comstock said.

Along with traditional lighting manufacturers, the "intelligent lighting" market is drawing companies that manage other building controls such as Honeywell, and start-ups focused on lighting controls, according to Jesse Foote, analyst at Navigant Research.

"There are so many kinds of companies getting into the space," Foote said.

http://www.reuters.com/article/2015/05/04/us-general-electric-light-idUSKBN0NP1IP20150504

Monday, May 4, 2015

China unlikely to develop home-grown DRAM technology within five years, say Nanya and Inotera

Responding to China's ambitions to step into the memory

industry, Inotera Memories and Nanya Technology both believe that it is

unlikely China can develop home-grown DRAM technology within at least

five years.

China might be able to gain access to

proprietary technologies through technology licensing, but building a

certain scale of production capacity would still require a period of

time, the Taiwan-based DRAM makers commented. That means China's impact

on the memory industry would not be felt until after 2-3 years, the

makers said.

The key DRAM technologies are being held

by Samsung Electronics, Micron Technology and SK Hynix. Under the

current circumstances, none of the vendors should consider licensing

their technologies to China-based companies as they are aware of

oversupply concerns, the makers indicated.

The global

DRAM industry just ended its two-year downturn, and has begun to benefit

from a healthier supply-demand dynamic, the makers said.

In

addition, Nanya said that the company has no intention to set up a

production base in China. Nanya added the company will continue to

improve its product mix and improve its cost structure.

Nanya

is also in the progress of transitioning to 20nm process technology,

and is striving to enhance its low-power DRAM technology portfoliio for a

wide range of market applications, the company said. Nanya is looking

to enter volume production of 20nm chips in the second half of 2017, and

build additional LPDDR4 and DDR4 product lines.

http://www.digitimes.com/news/a20150430PD200.html

Friday, May 1, 2015

NXP CEO on China, Apple Pay, IoT & V2V

MADISON, Wis. — NXP Semiconductors posted in

the first quarter of 2015 total revenue of $1.47 billion, an increase of

17.7 percent over the same period a year ago. Richard Clemmer, NXP CEO,

attributed the first quarter results to the company’s “better product

mix, which drove better profitability.” NXP’s non-GAAP operating margin

in the first quarter was 26 percent.

A merger of NXP and Freescale is expected in the second half of this

year. Clemmer confidently spoke of significant integration planning

already under way. This “should assure a successful Day One execution of

the merger,” he said.NXP is also likely to have a buyer for its RF power business in the next few months. Due to the sheer size of the two companies’ combined RF power business, Clemmer had previously talked about selling NXP’s RF power business in order to meet regulatory guidelines.

NXP has received interest from “quite a number of entities,” said Clemmer, during the conference call. “We've actually narrowed that down and have entered a process to try to get to an agreement here over the next couple of months.”

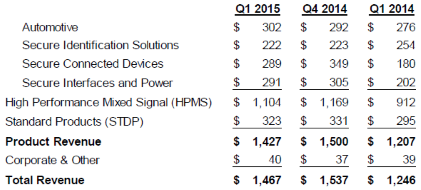

NXP divides the company’s business into five product categories, including automotive, secure identification solutions, secure connected devices, secure interfaces and power, and high-performance mixed signal and standard products.

Product revenue combines revenue from

the High Performance Mixed Signal (HPMS) and Standard Products (STDP)

segments. Percent of quarterly total amounts may not add to 100 percent

due to rounding.

IoT — Dot-com phenomena?NXP, however, does not segment IoT as a separate product category.

One financial analyst said that some competitors are already starting to break out IoT in their numbers. When he prodded Clemmer to speculate on the trajectory of the IoT market, Clemmer responded: “It sounds like the dot-com phenomenon.”

At NXP, he said “we prefer to call it the smarter world as opposed to the Internet of Things.” He added that “smarter world” is “a little bit more descriptive than just the IoT, which is still relatively undefined.”

Semantics aside, when it comes to IoT building blocks, Clemmer said that NXP and Freescale combined will have all the fundamental capabilities, including sensing, processing, connectivity and security. He noted that the merged company will be in a “true leadership position” to serve the evolution of IoT beyond “what either of us could have done on a standalone basis.”

Clemmer cautioned that IoT will still need more time to generate material revenue. While acknowledging some indications for “ramp-ups of design wins,” he noted that any such early successes “still end up being relatively immaterial in the whole scheme of things if you look at the revenue impact itself.”

Apple Pay

For NXP watchers, the mobile payment business might be an area of concern — in terms of its growth. In the first quarter, NXP’s revenue in Secure Identification Solutions was $222 million, down 13% from the same period in the prior year and flat sequentially.

Clemmer downplayed the uncertainty of the market, and said, “During the quarter, we began to see incremental improvement in the bankcard market, with positive trends in both China and the U.S.”

Further, he added that NXP continues to see “strong growth” in mobile payments.

http://www.eetimes.com/document.asp?doc_id=1326498

Subscribe to:

Posts (Atom)