NAND flash memory is a key enabler in today’s systems, but it’s a

difficult business. NAND suppliers require deep pockets and strong

technology to survive in the competitive landscape. And going forward,

vendors face new challenges on several fronts.

On one front, for example, the overall NAND market is currently in

the doldrums, amid soft product prices and a mild capacity glut. Demand

is expected to rebound in the second half of 2016, although there is

still uncertainty in the market.

Then, on the technology front, today’s planar NAND is reaching its

physical scaling limit. And so NAND suppliers are pinning their future

hopes on the successor to planar NAND—

3D NAND.

3D NAND is shipping, but the technology is taking longer than

expected to enter the mainstream. It is more difficult to make than

previously thought. 3D NAND resembles a vertical skyscraper, in which

horizontal levels or layers are stacked and then connected using tiny

vertical channels.

“The early movers, such as Samsung and Micron, are ramping up 3D NAND

quickly, while SK Hynix and SanDisk/Toshiba are lagging,” said Greg

Wong, an analyst with Forward Insights. “The technology and yield

learning is taking longer.”

And it isn’t getting any easier. Today’s leading-edge 3D NAND chips

are 32- and 48-layer devices, but the technology will likely hit the

ceiling at 128 layers in the 2018 timeframe or so. So to extend 3D NAND

beyond 128 layers, vendors are quietly developing a technology called

string stacking. Still in R&D, string stacking involves a process of

stacking individual 3D NAND devices on top of each other.

For example, a vendor might stack three separate 48-layer 3D NAND

devices, creating a 144-layer chip. Even with string stacking, though,

3D NAND could hit the wall at 300 layers. It will take vast resources

and capital to extend current and futuristic 3D NAND devices to 128

layers and beyond. “Scaling the number of layers is not just a technical

challenge, but an economic one as well,” Wong said.

In any case, OEMs will need to keep close tabs on the technology. To

help OEMs, Semiconductor Engineering has taken a look at the status of

the following technologies—planar NAND; 3D NAND; and futuristic 3D NAND

with string stacking.

Planar NAND

Invented in the 1980s, NAND flash is a

nonvolatile memory

technology that can be electrically erased and reprogrammed. Basically,

NAND is used for data storage applications. Its close cousin, NOR

flash, is geared for code storage. In today’s systems, NAND plays a key

role in the traditional memory hierarchy. Basically,

SRAM is integrated into the processor for cache.

DRAM is used for main memory. And disk drives and NAND-based solid-state drives (SSDs) and memory cards are used for storage.

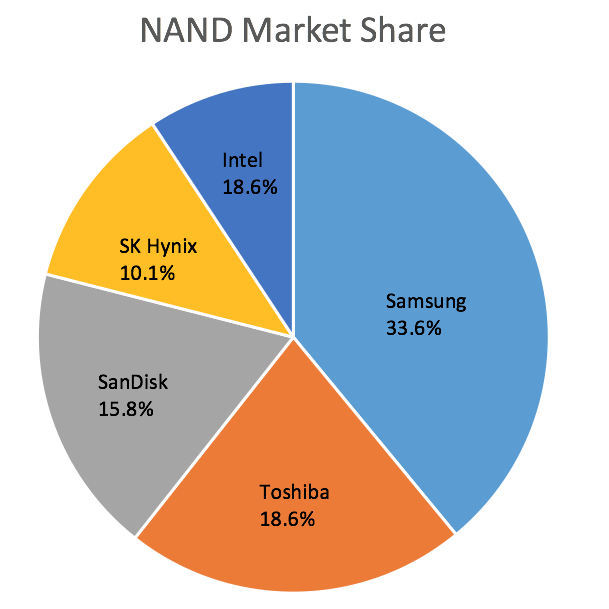

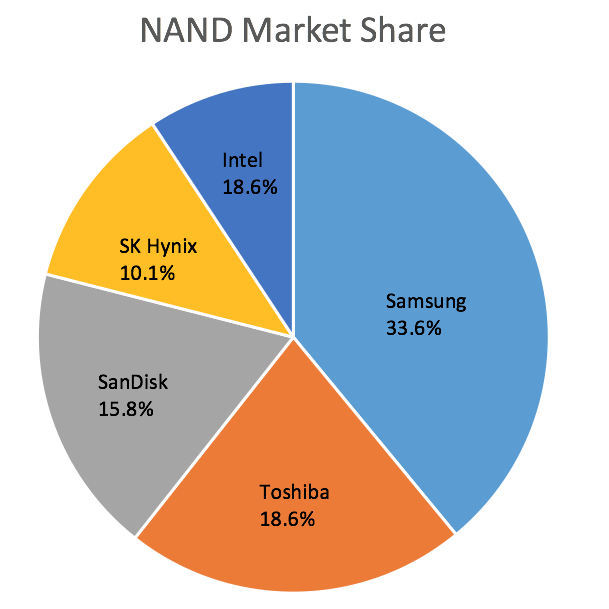

The NAND market is dominated by large suppliers. (See chart below.)

Source: Semiconductor Engineering chart compiled from TrendForce data.

Source: Semiconductor Engineering chart compiled from TrendForce data.

In 2015, worldwide NAND revenues increased by 10%, while bit growth

grew by 52%, according to Web-Feet Research. “In 2016, revenue will be

flat at a 0.4% growth rate even though bit growth will come in around

46%,” said Alan Niebel, president of Web-Feet Research. “This is due to

oversupply of planar NAND and price declines for mobile, consumer and

some SSDs.”

Today, prices for planar NAND are inexpensive and continue to fall.

Not long ago, for example, hard disk drives (HDDs) were significantly

cheaper than rival NAND-based SSDs. By year’s end, the price difference

between a 128-GB SSD and a 500-GB HDD will fall to less than $3,

according to TrendForce.

For OEMs, though, there is a potential problem. NAND flash vendors

have converted some of their planar NAND fab capacity over to 3D NAND.

If demand picks up, and vendors can’t ramp up 3D NAND fast enough, OEMs

could face product shortages in the second half of 2016 and perhaps

beyond.

“Our outlook is for a shortage in NAND in general,” said Jim Handy,

an analyst with Objective Analysis. “It all depends on whether or not

people are able to overcome the technical barriers to get out 3D NAND.

And it’s really hard to predict when that will happen.”

The other problem? Planar NAND is running out of steam.

Planar NAND is running out of steam, but it’s far from dead.

Planar NAND is based on a floating gate transistor structure. A NAND

device, which resembles a MOSFET, consists of a source and a drain with a

channel running between them. Unlike a MOSFET, there are two gates on

the top of a NAND structure. A control gate is on top, while the

floating gate is on the bottom. The two gates are insulated by an oxide

layer.

The data is stored in a NAND cell. In single-level cell (SLC) NAND

flash, there is 1 bit of data per cell. Today’s mainstream NAND makes

use of multi-level cell (MLC) and triple-level cell (TLC) technology,

which stores 2 bits and 3 bits of data per cell, respectively.

NAND vendors have scaled the cell size by roughly 100 times over the

past decade, according to Micron Technology. In fact, thanks to advanced

lithography, vendors have extended planar NAND down to the mid-1xnm node regime.

Today, NAND vendors are shipping 16nm and 15nm parts. But at those

nodes, NAND is running of out of gas and it will no longer scale. It is

becoming difficult to scale the memory cell and floating gate in planar

NAND.

But planar NAND is not dead. “Planar NAND is not going away,” said

Kevin Kilbuck, director of NAND strategic planning at Micron. “Customers

want 2D NAND for the foreseeable future for let’s call it the non-high

capacity storage market. Not all of the applications are moving to 3D

NAND right away. And not all of the manufacturers will convert all of

their capacity from 2D to 3D NAND overnight. It’s not economical to

manufacture low-density products in 3D NAND fabs. It’s also very

expensive to build new 3D NAND fabs or covert 2D NAND fabs to 3D.”

3D NAND

Still, the future rests with 3D NAND. This technology first appeared in

2007, when Toshiba introduced the world’s first 3D NAND technology.

Later, Samsung, SK Hynix and the Micron/Intel duo introduced 3D NAND.

3D NAND represents a radical departure from planar or 2D NAND. Planar

NAND involves the production of horizontal strips of polysilicon. The

strips are used to make the wordlines. These, in turn, connect the

control gates of the memory cells.

In 3D NAND, the polysilicon strips are stretched, folded over and

stood up vertically. Basically, 3D NAND involves a stack of layers. The

layers are connected with tiny vertical channels. The layers, which are

horizontal, are the active wordlines. “The bitlines also run

horizontally in the metal layers on the top of the chip,” Objective

Analysis’ Handy said. “The vertical channels are the NAND ‘strings’ that

attach to the bitlines.”

There are other differences as well. Micron and its technology

partner, Intel, extended the floating gate architecture to 3D NAND. In

contrast, Samsung, SK Hynix and the SanDisk/Toshiba duo are not using a

floating gate for 3D NAND. Instead, these vendors went to a technology

called charge trap flash.

All told, 3D NAND has some advantages over planar NAND. “Compared to

planar NAND, 3D NAND offers a significant bit density increase,” said

Yang Pan, chief technology officer for the Global Products Group at

Lam Research.

“As such, there is increasing adoption of 3D NAND by SSDs as a storage

solution for servers/datacenters as well as high-end consumer

applications.”

Still, 3D NAND has some challenges. “From the device side, it’s the

channel mobility,” said Er-Xuan Ping, managing director of memory and

materials within the Silicon Systems Group at

Applied Materials. “Polysilicon does not have good mobility.”

In 3D NAND, the goal is to move the current through a

polysilicon-based vertical channel. A 3D NAND device with fewer layers,

and a shorter channel length, might have acceptable mobility.

Problems can arise as vendors scale their devices with more layers,

meaning the channel length becomes taller. “When you go up, the

polysilicon channel will be limited by its mobility,” Ping said.

Mobility is affected by the number of layers.

In addition, 3D NAND involves a number of new and complex process

steps in the fab. Planar NAND is dependent on advanced lithography. In

contrast, 3D NAND makes use of trailing-edge geometries from 40nm to

20nm. 3D NAND requires lithography, but the challenges shift from

advanced patterning to deposition and etch.

Despite the challenge, 3D NAND is set to take off. In 2015, the

overall 3D NAND market reached $4.5 billion in terms of sales, according

to Web-Feet Research. “In 2016, 3D NAND will come in big time with both

Toshiba and Micron producing volume shipments, thereby growing

worldwide bit shipments by 350% and revenues by 230%,” Web-Feet

Research’s Niebel said.

Each vendor, meanwhile, is ramping up 3D NAND at various stages. In

2013, Samsung shipped the world’s first 3D NAND device, a 24-layer,

128-gigabit (Gb) chip. Then, last year, Samsung shipped its

third-generation 3D NAND device. The device is 48 layers, based on

tri-level cell (TLC) technology, resulting in a 256-Gb chip.

Samsung’s

previous chip was a 32-layer chip. The 48-layer device is roughly 2X to

2.2X faster in terms of a sequential read and a sequential write,

according to Jim Elliott, corporate vice president of Samsung

Semiconductor.

The 48-layer chip also enables Samsung to penetrate new markets,

namely the enterprise SSD sector. “The big story is TLC in the

enterprise space,” Elliott said. “That’s where that disruption is taking

place.”

Samsung’s rivals, however, opted to skip the 24-layer regime. For

most, a 16nm or 15nm planar NAND chip is still cheaper on a cost-per-bit

basis than a 24-layer 3D NAND device.

Meanwhile, the Intel/Micron duo recently entered the 3D NAND market

by rolling out a 32-layer device. Meanwhile, SK Hynix and the

SanDisk/Toshiba duo are separately sampling 48-layer products.

The 32-layer device from Intel/Micron supports both multi-level cell

(MLC) and TLC technology, enabling densities of 256- and 384-Gb,

respectively. The 384-Gb chip, according to Micron, is the highest

density 3D NAND device in the market.

To accomplish this feat, Micron integrated the logic circuitry under the layer stack. It refers to this as

CMOS

under array. “We can get the majority of logic under the array, thereby

saving a lot of space. That allows more density in a given silicon

area,” Micron’s Kilbuck said. “It also allows us to segment the array.

It can increase the number of planes, for example. Our NAND pages are

divided into four planes. What that does is increase your throughput and

performance of an individual die.”

Despite the obvious benefits of 3D NAND, there is one big question: When will 3D NAND reach price parity with 2D NAND?

Today, 3D NAND is sold at a premium. The 32- and 48-layer devices are

inching closer in terms of price parity with 2D NAND. But it may take

chips with 64 layers and beyond to reach the magical price parity point.

“Our TLC-based 3D NAND is getting close to what 2D MLC can do in

endurance,” Kilbuck said. “My gut feeling is sometime next year we would

see price parity between 2D and 3D. I’m talking about price per

gigabyte. But everybody needs to be in high volume (production) for that

to occur.”

What’s next?

So what happens next? “This is the year of 48 layers going to 64,”

Applied’s Ping said. “Whether 3D NAND can go to 96 or 128 is limited by

the etching capability.”

In fact, it’s difficult to fabricate devices with 64 or more layers.

Right now, the high-aspect ratio etch tools are not ready or struggling

to fabricate devices at 64 layers and beyond. For now, the aspect ratios

are too complex and difficult.

And at 64 layers and beyond, channel mobility becomes an issue, as

previously stated. “It will limit the device performance or device

height,” Ping said.

So going forward, NAND suppliers will simultaneously follow two

parallel paths. The first path is to wait for the etch tools and other

manufacturing techniques to arrive. And if they arrive on time, vendors

could scale today’s 3D NAND device from 32- and 48-layers, to 64 layers,

to 96 and then to 128.

The second path is to move towards string stacking technology. This

involves stacking two or more individual devices on top each other. Each

device is separated by an insulating layer.

String stacking is already in the works. Recently, Micron presented a

paper on a new 64-layer chip. Micron, according to multiple sources,

stacked two 32-layer chips on top of each other.

In theory, string stacking could involve several different

combinations. For example, a vendor could stack three 32-layer chips,

enabling a 96-layer device. In addition, a vendor could stack three

96-layer chips, resulting in a 288-layer product.

The trick is to connect the various chips together. Today, vendors

are looking at several different interconnect schemes. “Some of them

will put a source line in the middle,” Ping said. “That is just one of

the many options.”

Clearly, string stacking is challenging. And even with this

technology, 3D NAND could hit the wall at 300 layers or so. “That’s the

limit,” he said. “That’s based on yield and stress.”

All told, 3D NAND will remain viable at least to 2020, and perhaps

beyond. But suddenly, 3D NAND has some new competition, which

complicates the landscape.

Today, the Intel/Micron duo are sampling 3D XPoint, a

ReRAM-like

device that could potentially compete with 3D NAND in enterprise SSD

applications. ReRAM, a nonvolatile memory technology, is attractive

because it delivers fast write times with more endurance than today’s

flash.

There are other promising technologies in R&D, particularly

vertical ReRAM. “The densities (in vertical ReRAM) won’t be as high as

3D NAND,” Ping said. “But the speeds can overcome some of these density

limitations.”

Time will tell if ReRAM will displace 3D NAND. In fact, ReRAM and the

other next-generation memory types still have a lot to prove. At one

time, the newfangled memory types were supposed to replace conventional

memory, but they have fallen short of their promises. And conventional

memory, such as DRAM and NAND, continue to chug along.

http://semiengineering.com/whats-next-for-nand/