Analog Devices P/N ADADC71KD - 110 pcs in stock

1037 DC

call 1-949-421-1144 or email pmeyers@gictg.com for more info.

Visit our website at:

www.gictg.com

Friday, May 8, 2015

Microchip Technology to Buy Micrel

http://www.wsj.com/articles/microchip-technology-to-buy-micrel-1431035341

Thursday, May 7, 2015

Samsung readies new processors to power the Internet of Things

Samsung's bet on the Internet of Thing is about to get a little smaller -- physically, that is.

The South Korean electronics giant on Tuesday plans to reveal new chip platforms to power Internet-connected devices, ranging from wearables to smart washing machines, sources tell CNET. The new hardware will be called Artik, said a person who didn't want to be named in talking about a product that's not yet announced, and it comes from Samsung's Menlo Park, Calif.-based Strategy and Innovation Center.

The group -- which is led by Young Sohn, president and chief strategy officer of Samsung Electronics -- has been tasked with seeking new technology, partnerships and investments in hardware, generally with a longer-term view. Sohn, who launched a $100 million US investment fund for Samsung in early 2013, has seen his role expand in recent months to include oversight over more of Samsung's investments and its research and development. In total, Samsung has allocated more than $1 billion to fund US startups.

Sohn will introduce Artik during a keynote at the Internet of Things World conference on Tuesday in San Francisco. In a press release about the keynote, Samsung has said it "will reveal a major company milestone that will enable the new wave of groundbreaking IoT devices and services. The event will bring together industry leaders, entrepreneurs, developers and emerging companies to discuss the future of IoT and its profound implications."

"By

continuing efforts to connect devices and people to achieve greater

insights, we have a huge opportunity to work with others in the

industry, to tackle these real-world issues in ways that will

fundamentally change people's lives for the better," Sohn said in the

press release.

Samsung has been making a big bet on the Internet of Things, the concept of using sensors and other technologies to hook just about anything you can think of into the Internet. Analyst firm Gartner predicts the number of networked devices will surge to 26 billion units by 2020 from about 900 million in 2009, turning formerly "dumb" objects into smart ones that can communicate with each other. IDC reckons the IoT market will hit $3.04 trillion that same year.

Last August, Samsung acquired smart-home startup SmartThings to help with its push. SmartThings' technology helps consumers to control their appliances from their smartphones, smartwatches and other devices, and it has been viewed as key to Samsung's smart-home and Internet of Things efforts.

During the 2015 Consumer Electronics Show in January, Samsung, led by co-CEO Boo-Keun Yoon, vowed that all of the company's products would be built on platforms that are open and compatible with other products. Yoon said that that 90 percent of its devices -- which range from smartphones to refrigerators -- would be able to connect to the Web by 2017. In five years, every product in the company's entire catalog is expected to be Internet-connected.

But Artik won't just be targeted at Samsung's own appliances. Instead, other device makers will be able to use the chips in their products.

Artik is the second product to come from Young's innovation initiative in the past year. In May 2014, the group revealed new open software and a so-called reference design hardware to better measure certain health characteristics of wearables users, including heart rate and blood pressure. Its Simband

fitness band reference design -- a template describing how a particular

technology should work -- incorporates a new sensor module that can be

used in future wearables, while a cloud-based software platform called

Samsung Architecture for Multimodal Interactions, or SAMI, can collect

sensor data from the devices for analysis.

As Samsung's core mobile business continues to struggle, the company is counting on its other businesses -- such as home appliances and semiconductors -- to boost its profits. Samsung is the world's biggest maker of memory chips and also manufactures application processors that serve as the brains of devices, including many of Apple's iPhones. The company's new Galaxy S6 and S6 Edge smartphones use Samsung's Exynos applications processor instead of a Qualcomm chip, as well as Samsung-made flash memory and the wireless chip that connects the phone to 3G and 4G networks.

Samsung largely targets Exynos at its own devices, and essentially no other companies buy the processors. But selling Artik to other device makers could give Samsung a boost. It also puts Samsung in fiercer competition with chipmakers such as Intel and Qualcomm, which make their profits from supplying processors, not the devices that use them. All of the companies have been looking to wearables and the Internet of Things as new areas of growth.

Intel, for instance, in January revealed a processor platform for wearables, dubbed Curie. The button-sized device includes a processor, Bluetooth low-energy radio, sensors and a dedicated engine to determine different sporting activity. It's also able to run for extended periods with a coin-size battery, or can be recharged. Such a minuscule chip could power wearables of different designs, from rings to pendants to clothes. Curie and Samsung's Artik may be competing for many of the same customers.

http://www.cnet.com/news/samsung-readies-new-processors-to-power-the-internet-of-things/

The South Korean electronics giant on Tuesday plans to reveal new chip platforms to power Internet-connected devices, ranging from wearables to smart washing machines, sources tell CNET. The new hardware will be called Artik, said a person who didn't want to be named in talking about a product that's not yet announced, and it comes from Samsung's Menlo Park, Calif.-based Strategy and Innovation Center.

The group -- which is led by Young Sohn, president and chief strategy officer of Samsung Electronics -- has been tasked with seeking new technology, partnerships and investments in hardware, generally with a longer-term view. Sohn, who launched a $100 million US investment fund for Samsung in early 2013, has seen his role expand in recent months to include oversight over more of Samsung's investments and its research and development. In total, Samsung has allocated more than $1 billion to fund US startups.

Sohn will introduce Artik during a keynote at the Internet of Things World conference on Tuesday in San Francisco. In a press release about the keynote, Samsung has said it "will reveal a major company milestone that will enable the new wave of groundbreaking IoT devices and services. The event will bring together industry leaders, entrepreneurs, developers and emerging companies to discuss the future of IoT and its profound implications."

Samsung has been making a big bet on the Internet of Things, the concept of using sensors and other technologies to hook just about anything you can think of into the Internet. Analyst firm Gartner predicts the number of networked devices will surge to 26 billion units by 2020 from about 900 million in 2009, turning formerly "dumb" objects into smart ones that can communicate with each other. IDC reckons the IoT market will hit $3.04 trillion that same year.

Last August, Samsung acquired smart-home startup SmartThings to help with its push. SmartThings' technology helps consumers to control their appliances from their smartphones, smartwatches and other devices, and it has been viewed as key to Samsung's smart-home and Internet of Things efforts.

During the 2015 Consumer Electronics Show in January, Samsung, led by co-CEO Boo-Keun Yoon, vowed that all of the company's products would be built on platforms that are open and compatible with other products. Yoon said that that 90 percent of its devices -- which range from smartphones to refrigerators -- would be able to connect to the Web by 2017. In five years, every product in the company's entire catalog is expected to be Internet-connected.

But Artik won't just be targeted at Samsung's own appliances. Instead, other device makers will be able to use the chips in their products.

As Samsung's core mobile business continues to struggle, the company is counting on its other businesses -- such as home appliances and semiconductors -- to boost its profits. Samsung is the world's biggest maker of memory chips and also manufactures application processors that serve as the brains of devices, including many of Apple's iPhones. The company's new Galaxy S6 and S6 Edge smartphones use Samsung's Exynos applications processor instead of a Qualcomm chip, as well as Samsung-made flash memory and the wireless chip that connects the phone to 3G and 4G networks.

Samsung largely targets Exynos at its own devices, and essentially no other companies buy the processors. But selling Artik to other device makers could give Samsung a boost. It also puts Samsung in fiercer competition with chipmakers such as Intel and Qualcomm, which make their profits from supplying processors, not the devices that use them. All of the companies have been looking to wearables and the Internet of Things as new areas of growth.

Intel, for instance, in January revealed a processor platform for wearables, dubbed Curie. The button-sized device includes a processor, Bluetooth low-energy radio, sensors and a dedicated engine to determine different sporting activity. It's also able to run for extended periods with a coin-size battery, or can be recharged. Such a minuscule chip could power wearables of different designs, from rings to pendants to clothes. Curie and Samsung's Artik may be competing for many of the same customers.

http://www.cnet.com/news/samsung-readies-new-processors-to-power-the-internet-of-things/

Wednesday, May 6, 2015

Intel's 18-core Xeon chips tuned for machine learning, analytics

Smaller servers are taking over data centers, but Intel believes the future is also bright for powerful

big-iron servers, thanks to companies' embrace of machine learning,

which requires a lot of horsepower to process complex algorithms and

large data sets.

With its new top-line Xeon E7 v3 server chips based on the Haswell microarchitecture, Intel hopes to capitalize on the demand for this type of server. With up to 18 CPU cores, the chips are Intel's fastest, and designed for databases, ERP (enterprise resource planning) systems and analytics related to machine learning.

Complex machine learning models can't be distributed over the cloud or a set of smaller hyperscale servers in a data center. Instead, a more powerful cluster of servers is needed to run deep-learning systems, where the larger number of cores could power more precise analysis of oceans of data.

"To create an algorithm to look across thousands of genomes, and to look for correlations, is not the sort of workload that existed a few years ago," said Ron Kasabian, general manager of Big Data Solutions at Intel.

Intel is adapting the E7 chips to a fast-changing server market, where companies like Google, Facebook and Amazon have redefined data center designs. Those companies build mega-data centers around single or two-socket servers which are cheap and can be installed by the hundreds to handle the ever-growing data traffic.

The E7 chips are targeted at more powerful servers with four or more sockets, which don't typically fit in the Web hosting or hyperscale profile. These are typically servers used for databases and ERP, and companies are also using them for analytics to make better business projections and decisions.

Cloud servers or distributed computing environments -- like a Hadoop installation -- can tap into these powerful clusters to quickly extract information and then serve it to customers over the Internet. A large amount of data is being fed to smaller servers and appliances with more users coming online and the expansion of Internet of Things devices. The information can be sent back to the big-iron servers, which can analyze and help make sense of the information.

Intel has partnered with SAP to adapt the software company's applications to the E7 v3 chips. The companies claim the new chips are six times faster on leading enterprise applications than the Xeon E7 v2, which shipped last year and was based on the older Ivy Bridge architecture. The performance improvements come from chip improvements and SAP's software optimizations.

The Xeon E7 v3 chip, code-named Haswell-EX, has many new technologies such as DDR4 DRAM, a faster and more power-efficient form of memory which could enhance overall server performance. It supports 1.5TB of memory per socket, so an eight-socket server could host a mammoth 12TB of memory, which is useful for in-memory applications like databases.

The CPU is about up to 40 percent faster than its predecessor, said Matt Lane, Xeon E7 product line manager of Intel's Data Center Group.

Intel's architecture is becoming more flexible, and the company could create derivatives of the Xeon E7 v3 personalized for specific customers that may order chips in bulk, Lane said. Intel has already customized some previous Xeon E7 v2 chips to run faster with Oracle databases.

Dell, Hewlett-Packard and Lenovo are among a handful of companies launching servers with the new chips.

Intel's new E7 chips include four 18-core chips and eight chips with four to 16 cores. The fastest chip is the E7-8890v3, which runs at 2.5GHz, has 45MB of cache and is priced at US$7,175. The entry-level eight-core E7-4809v3 has a clock speed of 2.0GHz, 20MB of cache, and is the cheapest of the new offerings at $1,224.

http://www.pcadvisor.co.uk/news/enterprise/3610660/intels-18-core-xeon-chips-tuned-for-machine-learning-analytics/

With its new top-line Xeon E7 v3 server chips based on the Haswell microarchitecture, Intel hopes to capitalize on the demand for this type of server. With up to 18 CPU cores, the chips are Intel's fastest, and designed for databases, ERP (enterprise resource planning) systems and analytics related to machine learning.

Complex machine learning models can't be distributed over the cloud or a set of smaller hyperscale servers in a data center. Instead, a more powerful cluster of servers is needed to run deep-learning systems, where the larger number of cores could power more precise analysis of oceans of data.

"To create an algorithm to look across thousands of genomes, and to look for correlations, is not the sort of workload that existed a few years ago," said Ron Kasabian, general manager of Big Data Solutions at Intel.

Intel is adapting the E7 chips to a fast-changing server market, where companies like Google, Facebook and Amazon have redefined data center designs. Those companies build mega-data centers around single or two-socket servers which are cheap and can be installed by the hundreds to handle the ever-growing data traffic.

The E7 chips are targeted at more powerful servers with four or more sockets, which don't typically fit in the Web hosting or hyperscale profile. These are typically servers used for databases and ERP, and companies are also using them for analytics to make better business projections and decisions.

Cloud servers or distributed computing environments -- like a Hadoop installation -- can tap into these powerful clusters to quickly extract information and then serve it to customers over the Internet. A large amount of data is being fed to smaller servers and appliances with more users coming online and the expansion of Internet of Things devices. The information can be sent back to the big-iron servers, which can analyze and help make sense of the information.

Intel has partnered with SAP to adapt the software company's applications to the E7 v3 chips. The companies claim the new chips are six times faster on leading enterprise applications than the Xeon E7 v2, which shipped last year and was based on the older Ivy Bridge architecture. The performance improvements come from chip improvements and SAP's software optimizations.

The Xeon E7 v3 chip, code-named Haswell-EX, has many new technologies such as DDR4 DRAM, a faster and more power-efficient form of memory which could enhance overall server performance. It supports 1.5TB of memory per socket, so an eight-socket server could host a mammoth 12TB of memory, which is useful for in-memory applications like databases.

The CPU is about up to 40 percent faster than its predecessor, said Matt Lane, Xeon E7 product line manager of Intel's Data Center Group.

Intel's architecture is becoming more flexible, and the company could create derivatives of the Xeon E7 v3 personalized for specific customers that may order chips in bulk, Lane said. Intel has already customized some previous Xeon E7 v2 chips to run faster with Oracle databases.

Dell, Hewlett-Packard and Lenovo are among a handful of companies launching servers with the new chips.

Intel's new E7 chips include four 18-core chips and eight chips with four to 16 cores. The fastest chip is the E7-8890v3, which runs at 2.5GHz, has 45MB of cache and is priced at US$7,175. The entry-level eight-core E7-4809v3 has a clock speed of 2.0GHz, 20MB of cache, and is the cheapest of the new offerings at $1,224.

http://www.pcadvisor.co.uk/news/enterprise/3610660/intels-18-core-xeon-chips-tuned-for-machine-learning-analytics/

Tuesday, May 5, 2015

GE ties up with Qualcomm, Apple in new lighting business bet

General Electric Co on Monday announced collaborations with Qualcomm Inc and Apple Inc as it uses digital technology and the growing appetite for data to reinvigorate its 130-year-old lighting business.

With chipmaker Qualcomm, GE is offering retailers a way to connect with shoppers' smartphones through technology embedded in LED light bulbs, the company said. One use of the "indoor positioning" technology could be to transmit customized coupons to shoppers depending on their store location.

GE also said it will produce an LED bulb compatible with Apple's yet-to-launch connected-device platform HomeKit. The bulb can change colors to align with the natural rhythms of the body.

ADVERTISING

While GE sees an opportunity in selling energy-efficient LED bulbs, it will seek to use sensors and other technology embedded in LEDs to the advantage of consumers, businesses and cities, said Beth Comstock, who leads GE Business Innovations.

Services offered by GE stand to provide revenue that could offset pressure should the LED bulb business become more commoditized.

"There’s now a data stream from light that is going to create opportunity to be more productive," said Comstock, in her first interview about the lighting strategy since September, when the unit became part of GE's innovations division.

GE itself is undergoing a sweeping overhaul, jettisoning the bulk of its finance division to focus on big-ticket industrial products such as jet engines and power turbines.

Some analysts have speculated the U.S. conglomerate will divest lighting after deciding last year to sell its appliances segment and moves by Siemens and Philips to hive off lighting units. GE Lighting totaled about $2.5 billion in revenue last year, 2.3 percent of the company's overall industrial sales.

Comstock said lighting fits smoothly with GE Chief Executive Jeff Immelt's desire to marry software and analytics with GE's various industrial equipment, which GE calls the "Industrial Internet."

"LEDs plus software, it helps GE continue its Industrial Internet expansion and I think the lighting business has a big role in GE's future because of that," Comstock said.

Along with traditional lighting manufacturers, the "intelligent lighting" market is drawing companies that manage other building controls such as Honeywell, and start-ups focused on lighting controls, according to Jesse Foote, analyst at Navigant Research.

"There are so many kinds of companies getting into the space," Foote said.

http://www.reuters.com/article/2015/05/04/us-general-electric-light-idUSKBN0NP1IP20150504

Monday, May 4, 2015

China unlikely to develop home-grown DRAM technology within five years, say Nanya and Inotera

Responding to China's ambitions to step into the memory

industry, Inotera Memories and Nanya Technology both believe that it is

unlikely China can develop home-grown DRAM technology within at least

five years.

China might be able to gain access to

proprietary technologies through technology licensing, but building a

certain scale of production capacity would still require a period of

time, the Taiwan-based DRAM makers commented. That means China's impact

on the memory industry would not be felt until after 2-3 years, the

makers said.

The key DRAM technologies are being held

by Samsung Electronics, Micron Technology and SK Hynix. Under the

current circumstances, none of the vendors should consider licensing

their technologies to China-based companies as they are aware of

oversupply concerns, the makers indicated.

The global

DRAM industry just ended its two-year downturn, and has begun to benefit

from a healthier supply-demand dynamic, the makers said.

In

addition, Nanya said that the company has no intention to set up a

production base in China. Nanya added the company will continue to

improve its product mix and improve its cost structure.

Nanya

is also in the progress of transitioning to 20nm process technology,

and is striving to enhance its low-power DRAM technology portfoliio for a

wide range of market applications, the company said. Nanya is looking

to enter volume production of 20nm chips in the second half of 2017, and

build additional LPDDR4 and DDR4 product lines.

http://www.digitimes.com/news/a20150430PD200.html

Friday, May 1, 2015

NXP CEO on China, Apple Pay, IoT & V2V

MADISON, Wis. — NXP Semiconductors posted in

the first quarter of 2015 total revenue of $1.47 billion, an increase of

17.7 percent over the same period a year ago. Richard Clemmer, NXP CEO,

attributed the first quarter results to the company’s “better product

mix, which drove better profitability.” NXP’s non-GAAP operating margin

in the first quarter was 26 percent.

A merger of NXP and Freescale is expected in the second half of this

year. Clemmer confidently spoke of significant integration planning

already under way. This “should assure a successful Day One execution of

the merger,” he said.NXP is also likely to have a buyer for its RF power business in the next few months. Due to the sheer size of the two companies’ combined RF power business, Clemmer had previously talked about selling NXP’s RF power business in order to meet regulatory guidelines.

NXP has received interest from “quite a number of entities,” said Clemmer, during the conference call. “We've actually narrowed that down and have entered a process to try to get to an agreement here over the next couple of months.”

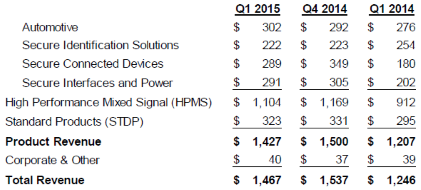

NXP divides the company’s business into five product categories, including automotive, secure identification solutions, secure connected devices, secure interfaces and power, and high-performance mixed signal and standard products.

Product revenue combines revenue from

the High Performance Mixed Signal (HPMS) and Standard Products (STDP)

segments. Percent of quarterly total amounts may not add to 100 percent

due to rounding.

IoT — Dot-com phenomena?NXP, however, does not segment IoT as a separate product category.

One financial analyst said that some competitors are already starting to break out IoT in their numbers. When he prodded Clemmer to speculate on the trajectory of the IoT market, Clemmer responded: “It sounds like the dot-com phenomenon.”

At NXP, he said “we prefer to call it the smarter world as opposed to the Internet of Things.” He added that “smarter world” is “a little bit more descriptive than just the IoT, which is still relatively undefined.”

Semantics aside, when it comes to IoT building blocks, Clemmer said that NXP and Freescale combined will have all the fundamental capabilities, including sensing, processing, connectivity and security. He noted that the merged company will be in a “true leadership position” to serve the evolution of IoT beyond “what either of us could have done on a standalone basis.”

Clemmer cautioned that IoT will still need more time to generate material revenue. While acknowledging some indications for “ramp-ups of design wins,” he noted that any such early successes “still end up being relatively immaterial in the whole scheme of things if you look at the revenue impact itself.”

Apple Pay

For NXP watchers, the mobile payment business might be an area of concern — in terms of its growth. In the first quarter, NXP’s revenue in Secure Identification Solutions was $222 million, down 13% from the same period in the prior year and flat sequentially.

Clemmer downplayed the uncertainty of the market, and said, “During the quarter, we began to see incremental improvement in the bankcard market, with positive trends in both China and the U.S.”

Further, he added that NXP continues to see “strong growth” in mobile payments.

http://www.eetimes.com/document.asp?doc_id=1326498

Subscribe to:

Posts (Atom)