DRAM demand is on the upswing as sales are expected to continue growing in the double digits through next year. More importantly, there is nothing usual about this latest cyclic rise in DRAM revenues.

While the DRAM sector will experience tighter capacity and rising unit prices as it has during past growth cycles, the supplier base has consolidated to such an extent that only three dominate players account for more than 90% of the market share. This means that heavy hitters Samsung, Hynix, and Micron have more leverage to raise prices than they would have been able to do during the past few years, as they, for the time being, try to put their low-margin and unstable pricing days behind them.

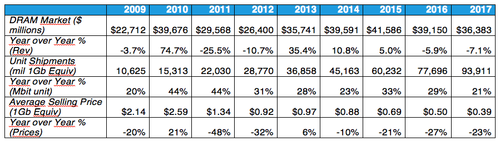

In the immediate future, DRAM suppliers, including the smaller players as well as the big three, are expected to benefit from double-digit growth and revenue gains thanks to higher pricing next year and in 2014. Following a 10.7% drop in DRAM revenues in 2012 to $26.4 billion, DRAM revenues are expected to surge 35.4% to $35.7 billion in 2013 and 10.8% to $39.6 billion in 2014, according to IHS iSuppli.

The rise in demand for DRAM as well as NAND flash memory, which is expected to see revenue growth of 27.7% in 2013, will lift the semiconductor market, IHS iSuppli says. Revenue growth driven by memory demand will increases by almost 5% to $317.9 billion. DRAM sales will account for 1.25% of the semiconductor industry's total growth worldwide, IHS iSuppli said.

Strong demand from the mobile sector from smartphones and tablets has helped the DRAM sector see growth. However, industry consolidation and what IHS iSuppli says is "more rational shipment growth" among DRAM makers are the main factors behind the up cycle.

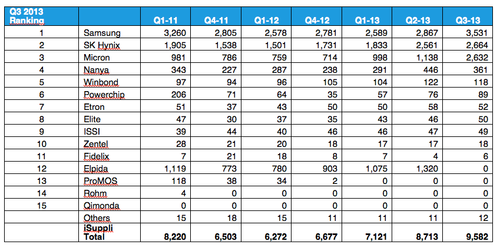

Samsung, Hynix, and Micron also collectively benefit as the surviving large players in the market following a wave of consolidation. They have a share of over 92% of all DRAM revenues worldwide. Samsung alone in the third quarter had a 37% share of the DRAM market. Hynix and Micron commanded shares of 28% and 27%, respectively, in the third quarter, according to IHS iSuppli.

Micron has especially benefited from the industry consolidation. In the context of the total chip market, Micron's share of the total semiconductor market will more than double to 4.5% in 2013, up from 2.2% in 2012, IHS iSuppli says. Micron's acquisition of Elpida Memory in 2012 was also a main factor in Micron's sales gains this year.

Samsung, Hynix, and Micron are using new market domination to stoke prices in the immediate future. They are doing this in part by not adding manufacturing capacity to meet demand and thus limiting supply growth to 25% to 30%, Mike Howard, senior principal analyst for IHS' DRAM and compute platforms group.

"There are only three DRAM companies left... and there is little threat right now that anyone will jump into the industry," Howard wrote in an email message. "It is our belief that the current players in DRAM are more focused on profits and less focused on market share... a situation that is tenable when [the large players] have at least 25 percent market share and untenable when there are a handful of players with 5-10 percent share."

The bad news for electronics OEMs is, of course, that they will have to wait for at least a year or so before they might be able to seek lower pricing from their DRAM suppliers.

"DRAM suppliers are responding to shortages by raising prices," Howard wrote. "We expect shortages in much of 2014 -- a situation that will keep prices from declining at historical rates."