New business models, acquisitions, investments are changing the semiconductor ecosystem.

Shifting business models, acquisitions, minority investments and

increasing uncertainty are creating fundamental shifts in the

semiconductor industry that could redefine who is successful in which

markets for years to come.

The announcement today that

Rambus

is developing memory controller chips, expanding its business beyond

just creating IP for the memory and security markets, is the latest in a

stream of public disclosures and behind-the-scenes deals that have been

underway for the past 18 months. And while the Rambus move is

significant by itself, in the context of all the other moves over the

past 18 months it blends into a landscape of equally dramatic changes.

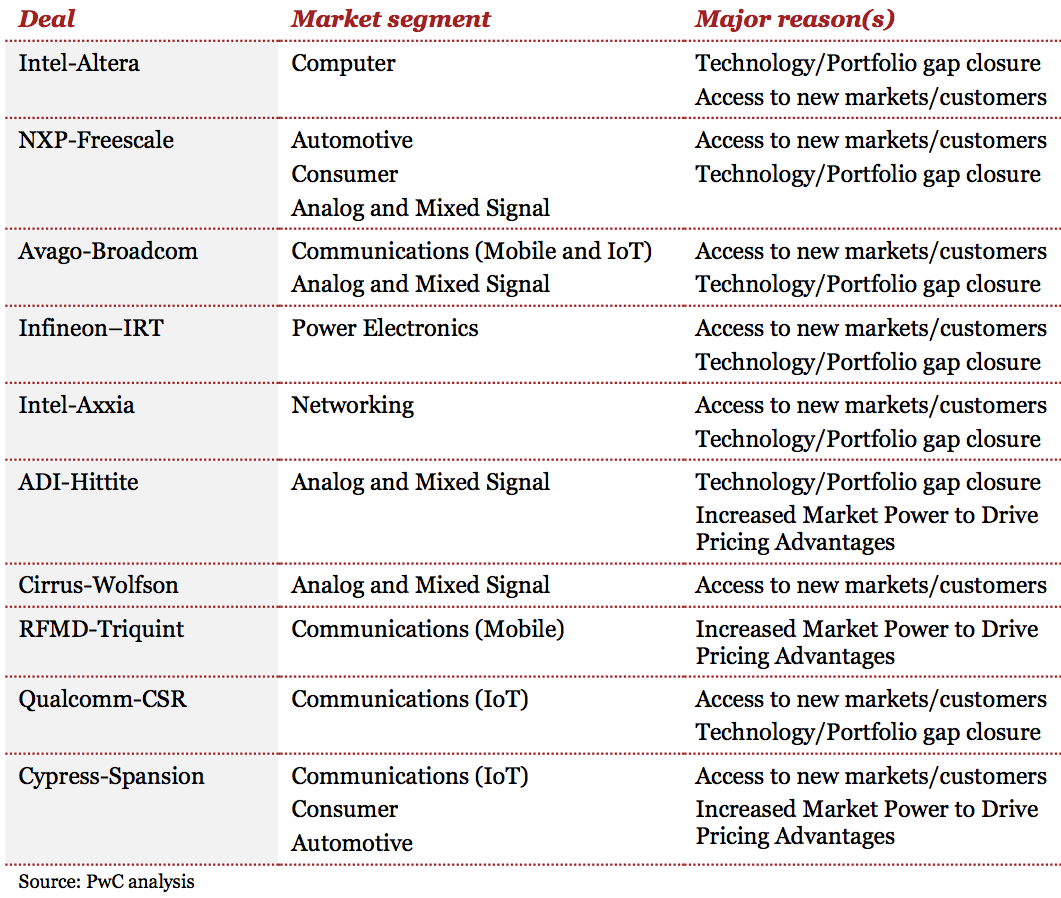

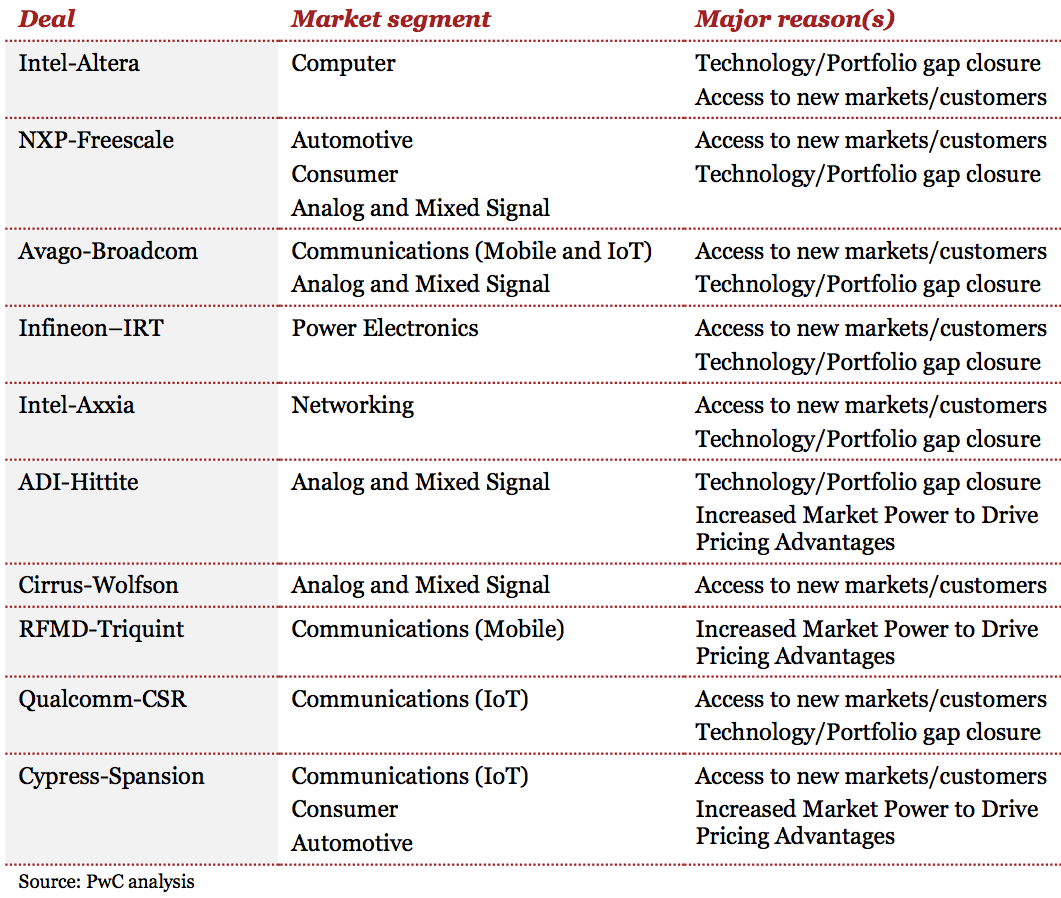

A just-released PricewaterhouseCoopers report identified several

drivers for the recent string of semiconductor industry acquisitions.

Among them are access to new markets or customers, closing up gaps in

portfolios, resource augmentation to enable scaling, and increased

market leverage.

“As any industry experiences slower growth and increasing cost

pressures, consolidation is a natural step,” said Rakesh Mehrotra, PwC’s

U.S. semiconductor advisory leader. “Semiconductor companies below $500

million are experiencing consolidation for this same reason and being

acquired by larger semiconductor companies. As new applications achieve

success and higher growth rate returns, we will see reduced

consolidation.”

Mehrotra noted that a good part of that consolidation is being driven

by a need to close up product portfolio gaps for emerging applications,

such as IoT/IoE and M2M. “Companies are exploring ways to offer

complete integrated solutions spanning sensing, processing, and

connectivity. Many of these capabilities are being integrated into

either a single-chip or a single-package to offer a more competitive

solution. In addition, we see consolidation is helping companies improve

their position in existing markets through scale efficiency and

increased share of wallet at key customers.”

In Rambus’ case, the opportunity fits a couple of those criteria,

namely access to new markets and portfolio gap closure. Jerome Nadel,

the company’s chief marketing officer, said it has been getting harder

and harder to create a server interface for DDR4 and top customers were

asking for help. The challenge for Rambus was developing a cohesive

strategy for continuing to provide IP—what Nadel calls “IP as a product

and IP in a product” — while making sure it didn’t step on the toes of

existing memory chip customers.

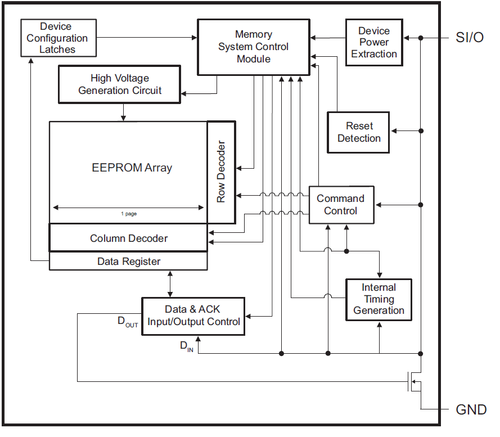

The solution was a DDR4 memory interface chipset that competes

directly with companies such as IDT, China’s Montage Technology, and

Inphi, but none of Rambus’ memory IP customers. At the same time,

considering that Rambus has been developing IP to work with this

interface technology for years, it adds another potential revenue stream

to Rambus’ IP portfolio. It will be designing and selling chips for the

first time using a fabless model.

“There are a couple of key market trends underway here,” said Ely

Tsern, vice president of Rambus’ memory products group. “One is the big

data wave, with an increase in memory, bandwidth and capacity, and there

has been a big uptake in servers and data centers. The second is a

transition from DDR3 to DDR4, which started last year and is seeing a

rapid adoption curve. The problem, though, is that DDR4 is really hard,

and it’s designed to increase in speed every year. To make that work,

you need buffer chips to see an increase in speed, and there are some

new fundamental challenges in the technology.”

Set in the context of the semiconductor IP industry, however, this deal isn’t all that surprising.

ARM,

Synopsys,

Cadence,

Mentor Graphics

and Rambus all have been buying up IP companies that are logical

extensions of their businesses into adjacent markets, such as software,

security, processors, subsystems, and memory verification IP. For all of

these companies, this has proven to be extremely lucrative. That

accounts for a string of Cadence acquisitions, elevating the company

from a virtual no-show in the IP business to the No. 4 hardware IP

provider, and it puts perspective on Mentor’s concerted push into

automotive software.

Even on the hardware side, these kinds of expansions are not out of the usual.

NXP‘s pending acquisition of

Freescale and

Intel‘s pending acquisition of

Altera

have a similar objective of growing share in their respective chip

markets. In fact, Intel sold off its FPGA business to Altera in the

1990s, and now is buying back that business plus the rest of Altera. The

company also purchased Docea Power late last month, ostensibly to help

with power and thermal simulation/modeling when Intel and Altera chips

are integrated together.

“This is the verticalization phase of the industry,” said Patrick

Moorhead, president of Moor Insights and Strategy. “We see this cycle

every 7 to 10 years, where the specialists realize that the sum of the

parts has more value than the parts. This is more of a

solutions-oriented approach, and you see this with companies like Apple,

as well as with ARM and TSMC, where you can have your part based on

what is a hard macro. ARM could produce chips if it wanted to. And MIPS

started out with chips, then moved to IP, and now is back to chips.

Really what this comes down to is control of the investment.”

Moorhead noted that with Rambus, there was a lot of pull from server

OEMs. “There was a demand for a new look and vision, and ironically it

was the end customers driving this. And Rambus was already getting so

far into debugging and fine-tuning that they were doing a lot of the

work, anyway.”

A bigger question mark for the whole ecosystem involves offshore

investments, particularly from China, which could accelerate all of

these moves and force deals as defensive measures. China’s technology

industry is looking to fill in gaps in its current offerings, and it is

much faster to buy than to build. That has has prompted a proposed $23

billion bid by Tsinghua Unigroup, a state-owned chip design company, for

Micron. According to Srini Sundararajan, analyst at Summit Research

Partners, that proposal is likely to evolve into an investment rather

than an acquisition due to national security concerns by the U.S.

government.

And behind all of this are questions from investors about where the

value will be for semiconductors over the next few years. While the

declines are flattening, according to the PWC report, the reduction in

ASPs from a high in 1995 and a resurgence in 2005 mean companies have to

fight for fewer dollars in hardware, or pick alternative approaches in

adjacent markets.

There are some bright spots, though. “For certain segments such as

automotive and industrial we expect to see ASPs stabilize driven by both

scale effects and the growing demand for semiconductor ICs within these

applications,” said PwC’s Mehrotra. “ASPs for computing and consumer

segments will continue to face downward pressure, especially for devices

such as sensor ICs and low-power embedded processors which are

experiencing growing volume forecasts.

http://semiengineering.com/fundamental-shifts-in-chip-business/